Will the Nepal Investment Summit 2024 Deliver On Its Promise

The third edition of Nepal Investment Summit is going to be held in Kathmandu on April 28-29. The Nepal Investment Summit Secretariat has informed that over 1,200 (including over 400 foreign delegates) have been invited for the two-day event. Potential investors from India, China, Europe, Gulf nations, Malaysia, East Asian, Bangladesh, United States of America and Australia are participating. Along with potential investors, representatives of lenders (development finance institutions) and development partners including multilateral development banks, UN agencies, PPP (public-private partnership) professionals, diplomats will be attending. The country’s policy makers, private sector, think tanks, will also be present at the summit.

“There will be conclaves, B2B & B2G meetings, policy dialogues, project showcasing, signing of MoUs and agreements, and networking opportunities,” said Sushil Bhatta, CEO of Investment Board Nepal. He added, “The summit is an initiative of the government to position Nepal as a promising investment destination.” Prime Minister, Pushpa Kamal Dahal, is scheduled to meet and interact with the investors.

The government has onboarded private sector umbrella organisations such as FNCCI, CNI and NCC as co-organisers. As announced in the fiscal budget 2023/24, the government in November last year decided to organise the summit in April of 2024.

Governing mechanisms are: Steering Committee (chaired by Finance Minister), Implementation Committee (chaired by Chief Secretary), Technical (project selection) Committee (chaired by secretary of the Ministry of Industry, Commerce and Supplies) and the NIS Secretariat (led by CEO of Investment Board Nepal) along with the task force (led by Secretary of the Office of the Prime Minister and Council of Ministers). The focus is on amendment of laws to create conducive environment for investment. The private sector umbrella organisations have representation in all the mechanisms formed to convene the summit.

There are two things which are critical for the success of the summit: firstly, what the government offers to the investors (foreign, domestic and diaspora community) including favourable investment climate (protection of investment, facilitation, incentives and profit repatriation among others), and secondly, lucrative (bankable and credible) projects. The private sector’s success in sealing B2B deals clearly relies on the government’ commitment to facilitate investment and provide protection on the ground of favourable investment climate.

Commitment versus reality

Prime Minister Pushpa Kamal Dahal, who is the Chairperson of Investment Board Nepal, said in the recently held 58th board meeting that the summit should not be a formality and the projects going to be showcased should not like a wish list. He urged the ministries to develop dedicated cells to provide support for leveraging financing to the PPP and private sector projects along with other facilitation work. In addition, the PM said that PPP is the only option to bridge the financing gaps and accelerate development works in line with the government’s priorities to achieve its target.

For PPP projects, we are not working with contractors, we are working with the developers and we will have comprehensive agreements known as project development agreements (PDAs), according to the Prime Minister. “If the government cannot fulfil its obligations as agreed, we have to pay compensation to the developer. This is why, we should be serious about facilitating the projects,” he added.

However, the harsh reality is that the private sector has been terrorised in the country following a series of assaults in the recent past. Moreover, the country’s bureaucracy is discouraged and demotivated. “Those who work might get victimised in the future and those who do not work are out of any risk,” a high-level bureaucrat requesting anonymity said, adding, “Bureaucrats don’t want to put their signature on anything and there is a trend of backwashing in government offices.”

The country’s laws and policies are not very investment friendly. There is procedural fatness, delays, rent-seeking, extortion as experienced by the existing investors. “The whole ecosystem should be investment friendly to lure investors. There is lack of interagency coordination, reluctance to work and insular type of mentality among the bureaucrats,” according to Keshav Acharya, an economist. “There is a need to overhaul the government system. The mindset of state machineries is against investment and profit. And they don’t respect the private sector,” he stated.

Amendment of laws through the Ordinance

The taskforce formed to recommend the amendment of laws and regulations that are obstructing investments had recommended the government to amend the various provisions of the Public Private Partnership and Investment Act, 2019; Industrial Enterprises Act, 2020; Foreign Investment and Technology Transfer Act, 2019; Special Economic Zone Authority Act, 2019; Forest Act, 2019; National Park and Wildlife Protection Act, 1973; Land Act, 1964; Land Acquisition Act, 1977; Environment Protection Act, 2019; Electronic Transaction Act, 2008; Civil Aviation Authority Act, 1996; Foreign Investment and Technology Transfer Rules, 2021 and Forests Regulations, 2022.

However, the government has issued ordinance for the amendment of Industrial Enterprises Act, 2020; Foreign Investment and Technology Transfer Act, 2019; Special Economic Zone Authority Act, 2019; Forest Act, 2019; National Park and Wildlife Protection Act, 1973; Land Act, 1964; Land Acquisition Act, 1977; Environment Protection Act, 2019.

Provisions of the ordinance prevail only for six months if the amendment is not endorsed by the parliament. “Experts said that laws should have been amended through the parliament but the government skipped the parliamentary process,” said Gandhi Pandit, senior advocate, adding, “This may not assure the investors.”

Citing provisions of Nepal’s primary act that deals with foreign investments, that is FITTA, which recognises only equity as foreign investments, he further said that loan/financing should be recognised as foreign investment in large-scale projects under the non-recourse financing model. Under the system of non-recourse financing model, the lender has access only to the project property to recover its debt and no authority to go after other property of the developer or equity holder as they do in recourse financing.

NIS 2024 projects

The government along with the private sector is showcasing a large number of projects, reportedly, a total of 151. There are 31 projects from the private sector and 120 projects are from government agencies. The projects are in different stages of study, according to Secretary of the Ministry of Industry, Commerce and Supplies, Krishna Bahadur Raut. “Projects will be showcased, procured (by calling Expression of Interest) and market sounding also will be conducted in the summit,” he informed.

There are projects of different sectors apart from private sector projects, including transportation (19 projects); mines and minerals (13 projects); tourism (16 projects); agriculture (14 projects); manufacturing (5 projects); industrial infrastructure and trade logistics (7 projects); energy including transmission line infrastructure (31 projects); water supply (4 projects); urban development (6 projects) and ICT (2 projects).

TRANSPORTATION

1. Bethanchowk Narayanthan Darsan Cable Car

2. Electric Bus Rapid Transit System in Kathmandu Ring Road

3. Chandragiri-Chitlang-Palung-Chitwan Expressway

4. Chitwan-Rampur-Butwal Expressway Project

5. Chitwan-Rampur-Pokhara Expressway Project

6. Fast Charging Station for Electric Vehicle Project

7. Sudurpashchim Public Transport Project

8. Public Transport Project in Madhesh Province

9. Multi-layer vertical parking at Patan Dhoka, Jawalakhel and Lamachaur

10. Malekhu-Lothar Road & Tunnel

11. Daunne Khanda Road Tunnel

12. Hemja-Nayapul Khanda Road Tunnel Project

13. Mirchaiya-Katari-Ghurmi Road

14. Dharan Leuti Road Tunnel

15. Metro Rail 1: Satdobato-Ratnapark-Narayangopal Chowk

16. Metro Rail 2: Kirtipur-Kalimati-New Baneshwor-Airport

17. Metro Rail 3: Koteshwor-Chabahil- Swayambhu-Koteshwor

18. Bus Park with modern terminal project, Pokhara Metropolitan City

19. Podway project, Pokhara Metropolitan City

MINES AND MINERALS

1. Mining of Limestone Deposit at Sabdu, Sitganga Municipality, Arghakhanchi District

2. Mining of Dolomite Deposit at Boje, Halesi-Tuwachung Municipality, Khotang District

3. Mining of Limestone Deposit at Dhuseni, Dhading District

4. Mining of Granite Deposit at Kaphal Dada, Roshi Rural Municipality, Kavrepalanchok

5. Mining of Iron and Copper at Jhunlabang, Bhume Rural Municipality, Rukum (East)

6. Mining of Limestone Deposit at Jaitpani, Khamilekh, Bangad Kupinde Municipality, Salyan District

7. Mining of Magnesite Deposit at Kampughat, Triyuga Municipality and Chaudandigadhi Municipality, Udayapur District

8. Prospecting of Gold at Dhokadhunga-Phuliban, Sunchhahari Rural Municipality, Rolpa District

9. Prospecting of Phosphorite at Dhikgad, Dogadakedar Rural Municipality, Baitadi District

10. Prospecting of Phosphorite at Sangau, Purchaudi Municipality, Baitadi District

11. Petroleum Exploration in Exploration Block No. 5 (Chitwan)

12. Petroleum Exploration in Exploration Block No. 4 (Lumbini)

13. Dhaubadi Iron Ore Project

TOURISM

1. Khaptad Integrated Tourism Development Project

2. Exhibition Centre Project, Pokhara Metropolitan city

3. Mulabari-Saunethup Foot Trail (White-wall) Project

4. Begnas-Rupataal Water Sports Project, Pokhara Metropolitan City

5. Janaki Heritage Hotel and Cultural Village Project

6. Development of Electric Mobility Corridor in Municipalities of Lumbini Corridor

7. Greater Lumbini Tourist Circuit Transportation Project

8. Nunthar Film City Project

9. Amusement Park in Baghmara, Chitwan

10. Rudrapurgadhi Tourism Project

11. Badhimalika Tourism Development Project

12. Mudi Tourism Development Project

13. Great Himalayan Trail Tourism Project

14. Dolakha Film City Project

15. Pokhara International Convention Centre (PICC)

16. Tal-Talaiya Multipurpose Tourism Project

MANUFACTURING

1. Glass Manufacturing Project

2. Capacity Expansion and Product Diversification of Dabur Nepal

3. Green Hydrogen and Green Ammonia Plant

4. Suryatara Cement Udhyog

5. Paper Factory Project

INDUSTRIAL INFRASTRUCTURE & TRADE LOGISTICS

1. Daiji Industrial District

2. Shaktikhor Industrial District

3. Development of Industrial Zone in Simara Special Economic Zone Block D & E

4. Panchkhal SEZ

5. Development of Special Economic Zone at Simara Block B and C, Project – Extension of Existing SEZ

6. China Nepal Friendship Industrial Park

7. Warehouse project, Pokhara Metropolitan City

AGRICULTURE

1. Integrated Fish Hatchery

2. High-End Resort

3. Slaughterhouse Construction and Operation

4. Establishment and Operation of Tea E-Auction centre and warehouse

5. Dog Chew/Chhurpi Export promotion and quality improvement project

6. Establishment of Bulk Cold Storage

7. Developing a model project of bio-fertiliser production and research centre, Nepal (BPRC-Nepal)

8. Promoting Investment in ginger value chain

9. Large cardamom chain enhancing trade

10. Highland potato value chain project

11. Value chain of timur (Sichuan Pepper) Project

12. Semlar Market, Butwal

13. Agroforestry Project (Rubber)

14. Pole Seasoning and Treatment Plant

ENERGY

1. Betan Karnali PRoR Hydropower Project (439 MW)

2. Humla Karnali Hydropower Project (61.02 MW)

3. Upper Chameliya Hydropower Project (53.85 MW)

4. Kokhajor Storage Hydropower Project (63 MW)

5. Kankai Multi-Purpose Project (60 MW)

6. Kawadi Khola Hydropower Project (30 MW)

7. Tom Dogar Budhigandaki Hydropower Project (40.20 MW)

8. Super Budhigandaki Hydropower Project (34.93 MW)

9. Compressed Bio Gas (CBG) Plant Project

10. Upper Marshyangdi -2 HEP

11. 250 MWp Grid connected Solar Project in Kohalpur and Banganga with total storage capacity of 40 MW

12. Naumure Multipurpose Project (281.04 MW)

13. Khimti Those Siwalaya Storage Hydropower Project (1,216 MW)

14. Kaligandaki-2 Storage Hydropower Project (650 MW)

15. Bharbhung Storage Hydropower Project (337.1 MW)

16. Karnali Chisapani Wind Power Project (10 MW)

17. Nalgad Reservoir Type Hydropower Project (417MW)

18. Inaruwa-Anarmani 400 kV Transmission Line and Associated Substation

19. Arun Hub (Sitalpati)-Inaruwa 400kV Transmission Line and Associated Substation

20. Tingla-Dudhkoshi-Dhalkebar 400kV Transmission Line and Associated Substation

21. Matatirtha-Dukuchhap 220kV Transmission Line Project

22. Dukuchhap-Teku 220 kV Transmission Line Project

23. Tingla Hub-New Khimti-Sunkoshi-Dhalkebar 400 kV Transmission Line Project

24. Budhigandaki Corridor (Philim-Gumba-Ratamate) 400 kV Transmission Line Project

25. Damauli-Kushma-Bafikot 400kV Double Circuit Transmission Line Project

26. Tamor-Dhungesangu 220kV Transmission Line Project

27. Hitar-Sitalpati (Arun Corridor) 400 KV TL Project

28. Simbuwa Khola Hydropower Project (70.3 MW)

29. Kimathanka Arun Hydropower Project (454 MW)

30. Mugu Karnali Storage Hydropower Project (1,902 MW)

31. Ghunsa Khola Hydropower Project (77.5 MW)

WATER SUPPLY

1. Kanke Deurali Water Impounding Reservoir Water Supply Project

2. Mahadev Khola Water Impounding Reservoir Water Supply Project

3. Sisneri Water Supply Project

4. Thonse Khola Water Impounding Reservoir Water Supply Project

URBAN DEVELOPMENT

1. New Town Development Project (Eeshan)

2. Auto Village project, Pokhara Metropolitan City

3. Underground Palika Bazaar at Lagankhel

4. Babarmahal Administrative Plaza

5. West Seti Town Planning Project

6. Gopi Krishna Central Complex

HEALTH AND EDUCATION

1. Public Schools Strengthening Project (PSSP)

2. Gautam Buddha Maternity Hospital

3. Dhulikhel Medicity Project

ICT

1. Data Centre Project

2. IT Park / Techno Park (Information Technology Development Park)

3. Mobile Assembly Plant

4. Laptop Assembly Plant

5. Digital Training Centre

PROJECTS PREPARED BY PRIVATE SECTOR

1. Sikles Annapurna Cable Car Project

2. Bharatpur Island Resort and Waterland Project

3. Middle Kaligandaki Hydroelectric Project

4. Tiplyang Kali Gandaki Hydroelectric Project

5. IME Cement Project (Baitadi)

6. Kathmandu Technical School

7. Gopi Krishna Central Complex

8. Jalpadevi Cable Car Project

9. Compost fertiliser plant

10. Revolving Parking

11. Upper Sani Bheri PROR Hydropower Project

12. Mugu Karnali Hydropower Project

13. Pelma Khola PROR Hydropower Project

14. Dana Khola Hydropower Project

15. Mathillo Budigandaki Hydropower Project

16. Landruk Modi Hydropower Project

17. Balephi Khola Hydropower Project

18. Chuwa Khola Cascade Hydropower Project

19. Upper Chuwa Lurupya Khola PROR Hydropower Project

20. Nar Khola Hydropower Project

21. Upper Apsuwa Hydropower Project

22. Upper Bheri Hydroelectric Project

23. Surke Dudhkoshi Hydropower Project

24. Upper Marshyangdi-1 Hydropower Project

25. Apsuwa Khola 1 Hydropower Project

26. 10 luxury hotels on the trails of Mount Everest in 3 Phases

27. Limestone excavation & transport using podway

28. Happy Land Fun Park & Resort, Surunga, Jhapa

29. Natural Agriculture Farm, Goru Singe, Taulihawa, Kapilvastu

30. Maakali Seti Cascade Peaking Hydroelectric Project (54 MW)

31. Seti Nadi Peaking Hydroelectric Project (72 MW)

The Technical Committee has said that globally practiced Project Screening and Analytics Tool (PSAT) and value for money (vfm) have been used for project selection. These projects are aligned with the nation’s priorities and the strategic feats of the Investment Board Nepal Project Bank Guideline.

Private sector perspective

The private sector umbrella organisations are co-organisers of the summit. Hence, the private sector to a large extent has taken the summit initiative as a positive action. However, the decisionmaker is ultimately the government. “The framework of Bilateral Investment Agreement (BIA) has been endorsed and more than half a dozen laws have been amended. The government and various other stakeholders are talking about investment and some projects are being discussed. This has at least, sensitised people of the issue of investment and brought that to the central stage once again,” said Chandra Prasad Dhakal, President of FNCCI. “It is obviously good that the private sector has been consulted by the government and we have been pushing the agenda of reform, which should be continued eve after the summit,” he stressed.

Rajesh Kumar Agrawal, President of CNI, said, “Garnering investment is a rigorous task and investment promotion events are imperative but not the ultimate solution. It requires a dedication, passion and will power of the government, then only the investors will trust us,” he said, adding, “Otherwise, such events will only contribute in promoting tourism of the country.”

Realisation of investment

The country has always witnessed a huge gap between the commitment/pledges and realisation of investment. One of the major objectives of the summit is to expand the realisation amount. Finance Minister Barsha Man Pun, however, says that the realisation amount is not pessimistic. “India, an emerging economy and reportedly largest FDI attractor of recent times has been realising just 30% of the pledges,” he said, adding, “In Nepal, realisation against the commitment is 37%, which is comparatively higher than the southern neighbour.”

However, the data of previous summits shows a different picture. Since the establishment of Investment Board Nepal, which deals with large-scale investments of above Rs 6 billion ($46 million) and energy projects of 200 MW or more capacity, it has received commitment of Rs 1,350 billion so far, and the realisation amount is Rs 137.86 billion. Similarly, investment realisation through the Department of Industry – first reference point for the investment threshold below Rs 6 billion – is around 18.5%, according to officials.

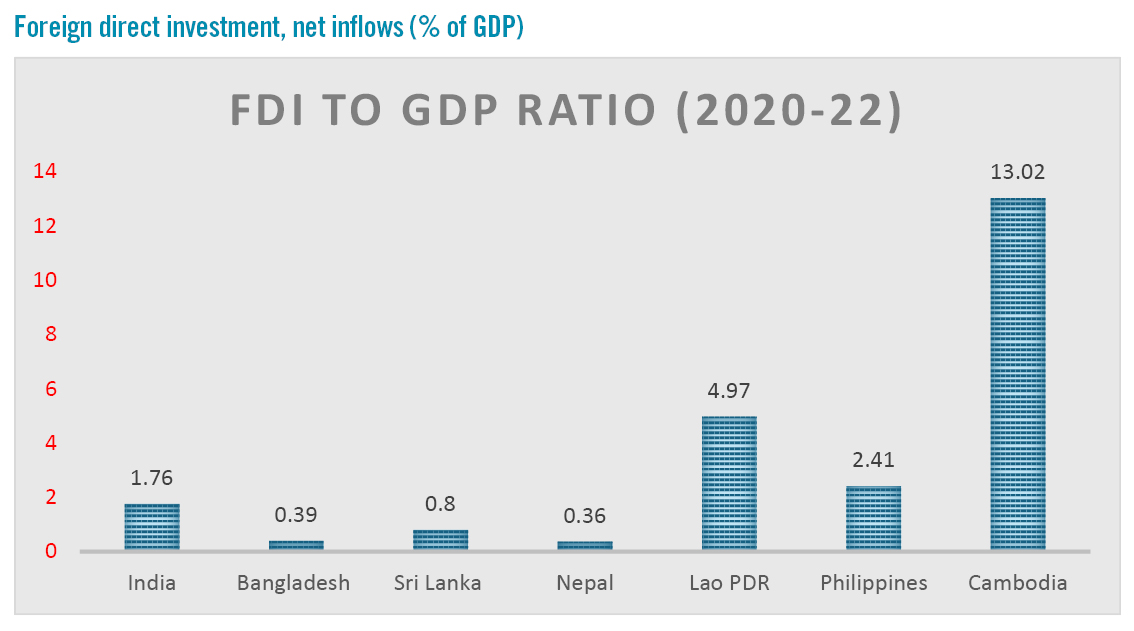

In South Asia, Nepal is towards the bottom in terms of FDI to GDP (gross domestic product) ratio, which is merely 0.4%. Foreign investors always anticipate the scenario, risks and what Nepal is offering to them. Nepal has to accept the fact that other countries are competing for FDI and without developing a competitive investment climate, Nepal may not be able to pursue the amount of foreign investment it aspires to.

-1765706286.jpg)

-1765699753.jpg)