KATHMANDU: Non-Life Insurance Business Association has again raised concerns with government bodies over a rule that prevents directors from selling promoter shares for one year after leaving office.

The association alerted the Securities Board of Nepal (SEBON) and the Nepal Insurance Authority that rule 38 (1A) of the Securities Registration and Issuance Regulations 2079—which bans directors from buying or selling shares while in office or for one year after resignation—is impractical.

A statement from the association said, "The share sale provision is highly impractical. It is unfair to prohibit directors from selling shares as other shareholders do simply because they are elected to the board."

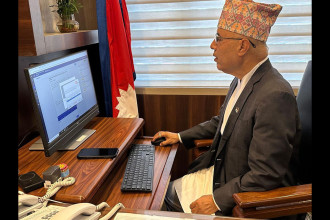

Rajendra Malla, immediate past president of the Nepal Chamber of Commerce (NCC), said an amendment has been requested, arguing that the one-year ban is impractical.

Malla, President of Non-Life Insurance Business Association, added that there is no financial difference between directors and other shareholders, and preventing directors from utilising their investments is unjust. He warned that if businesspeople are unable to sell their movable assets, it hinders enterprise diversification and essential household activities.

The association has called for an amendment allowing directors to sell up to 50% of their shareholding upon notifying the regulatory body while still holding the position. Malla stressed that the current provision harms the investment climate and deters foreign investment.

-1770991037.jpeg)