Nepal’s budget for FY 2025/26 is seen as a bold declaration of intent with a total allocation of Rs 1.96 trillion aimed at revitalising the economy, modernising infrastructure and improving public welfare.

At its core, the budget highlights a significant reliance on infrastructure development, particularly in sectors such as transportation, energy and urban development. While these projects are essential for economic growth, they come with a slew of questions at how well thought out are these plans.

Equally compelling is the budget’s emphasis on agriculture and rural development, a sector critical to Nepal’s socio-economic fabric. But its success lies in its adoption with migration to cities and urban areas, and seeking opportunities abroad continue to see a rise. The budget also places significant emphasis on tourism and hydropower, a long-standing repetition that requires at its very basic level, a masterplan.

The government’s push for digital tax reforms presents both an opportunity and a challenge. While digital systems could modernise tax collection and make the system more transparent and accountable, adaption by small businesses and the dominant informal needs incentives to adapt.

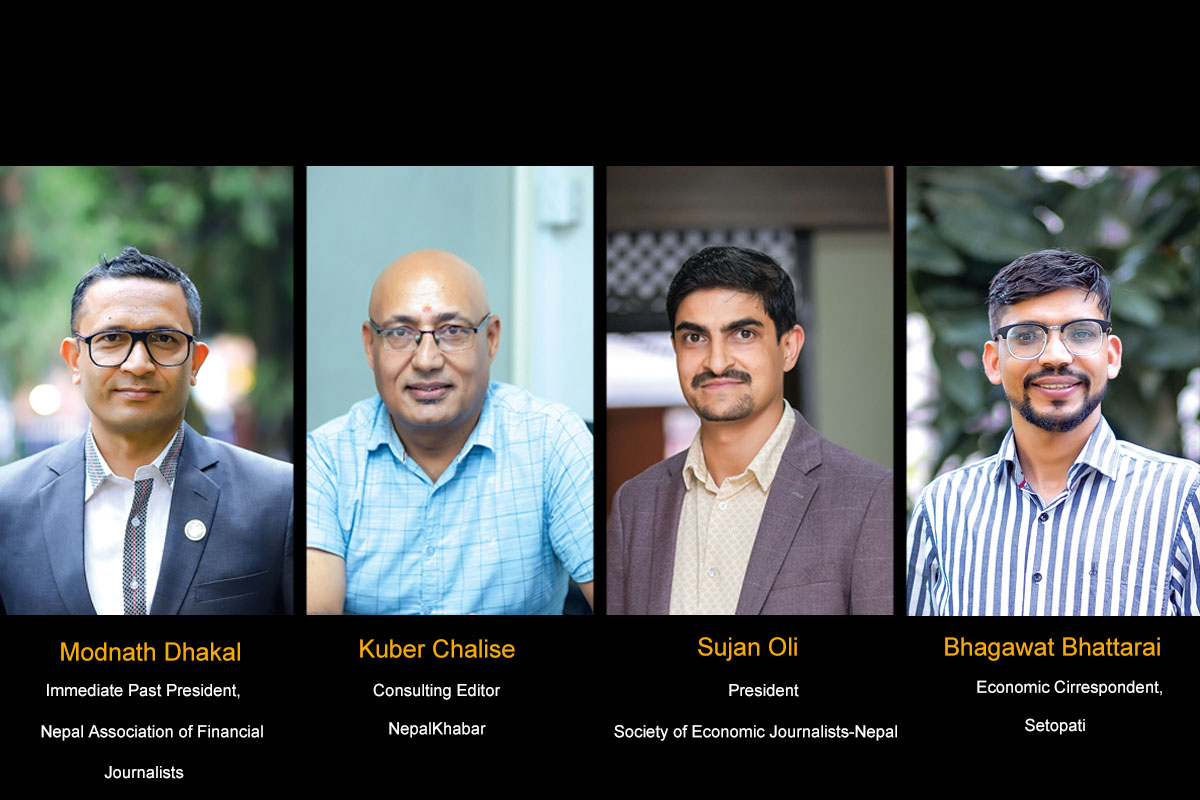

In this opinion segment, Modnath Dhakal, Immediate Past President, Nepal Association of Financial Journalists; Kuber Chalise, Consulting Editor, Nepalkhabar; Sujan Oli, President, Society of Economic Journalists-Nepal; and Bhagwat Bhattarai, Economic Correspondent, Setopati weigh in on some critical areas of the budget, offering their perspective and insight.

Is Nepal’s vision of economic growth sustainable with heavy reliance on infrastructure development?

Modnath Dhakal: Deputy Prime Minister and Finance Minister Bishnu Prasad Paudel announced a budget of Rs 1.964 trillion for the upcoming FY 2025/26 which is about 32% of the national Gross Domestic Product (GDP). Nepal’s economy is projected to reach the size of Rs 6.17 trillion by mid-July 2025 (end of the current Fiscal Year 2024/25). The size of the development allocation is just 20.8% (Rs 407.89 billion) of the total budget. However, the trends of the past several years show that government agencies are inefficient in mobilising the development budget. For example, the government could spend only 40% of the Rs 352 billion capital allocations for this year with just a month remaining. It means the performance from the last FY 2023/24 will continue this year as well. Last year, only 58% of the development budget of Rs 302 could be mobilised.

These statistics show that while the allocations to development projects are meagre, their utilisation is even weaker.

On the contrary, it is estimated that the country needs financial resources equal to 8%-12% of the GDP to meet the development need in the infrastructure sector alone which puts the numbers at around Rs 600 billion. If the country is to meet the Sustainable Development Goals (SDGs) by 2030, it needs to mobilise 40%-50% of its GDP. Nepal needs more resources for infrastructure development primarily in areas of transport, energy, urban facilities, irrigation and digital technology. It must develop infrastructure that will facilitate trade and promote health and education tourism which would help to create jobs and help to achieve high economic growth rate and sustainable development goals. It will reduce the gaps in the socio-economic sector.

Kuber Chalise: The vision of economic growth can only be sustainable with better infrastructure. Without lubricating the economy with improved efficiency, neither will the economic growth be sustainable nor achieve the annual target. In Nepal’s case, the government’s inefficiency in development works, both on hardware and software parts, has eroded the country’s capacity for economic growth.

Nepal’s vision of economic growth has blurred due to a lack of reliance on infrastructure development (hardware), and institution building and human capital development (software), which are prerequisites for sustainable economic growth. For example, the poor road condition across the country has added unnecessary costs to the economy making it uncompetitive, and the government’s failure to accelerate infrastructure development, as they take at least a decade to complete with cost and time escalation, makes even difficult to achieve economic growth target.

Sujan Oli: Nepal’s economic planning hasn’t specifically prioritised the fee structure group as a key engine of growth. Therefore, it’s inappropriate to claim that Nepal heavily relies on infrastructure development. In some sectors, like local road construction, projects proceed without proper environmental impact analyses or engineering. Nepal’s infrastructure, including roads, energy and communication, suffers from chronic underinvestment, inefficient allocation and suboptimal outcomes. To boost infrastructure productivity, the transportation network must support the value and supply chains of Nepali products. Communication infrastructure should aid producers, especially farmers, in exploring markets and prices for their produce, and energy infrastructure must support increased manufacturing output, among other benefits.

Bhagwat Bhattarai: Here, two aspects need to be considered. Our government’s thinking seems to be based on infrastructure development. In reality, the lack of necessary infrastructure is the main reason for sluggish economic growth. I believe that basic infrastructure development significantly impacts people’s mindset and entrepreneurial thinking.

However, infrastructure alone is not a sufficient basis for sustainable economic development. If the built infrastructure cannot be utilised, it can lead to reverse damage, an example of which we have already observed in Sri Lanka. Along with infrastructure, the development of skilled human resources, technology and a favourable environment for enterprises is also necessary. Infrastructure investment fulfills the minimum condition for improving living standards.

The Ministry of Physical Infrastructure has allocated Rs 10.74 billion for poverty alleviation, Rs 84.49 billion for supporting industrialisation and innovation, Rs 52.34 billion for building inclusive and safe cities, and Rs 294.7 million for institutional strengthening in next year’s budget.

However, the current investment is insufficient and the returns on existing investments are also not satisfactory. In the upcoming 2082/83 budget of Rs 1.964 trillion, the Ministry of Physical Infrastructure has a budget of Rs 151 billion, the Ministry of Urban Development has Rs 118 billion, and the Ministry of Energy, Water Resources and Irrigation has Rs 86 billion. However, the budget is scattered across small, fragmented projects, which do not provide long-term benefits. Collaboration with the private sector in infrastructure development has not been possible.

In summary, sustainable development is not possible by focusing solely on infrastructure but sustainable economic development is also not possible without minimum infrastructure development.

Nepal’s economy is projected to reach the size of Rs 6.17 trillion by mid-July 2025 (end of the current Fiscal Year 2024/25). The size of the development allocation is just 20.8% (Rs 407.89 billion) of the total budget. However, the trends of the past several years show that government agencies are inefficient in mobilising the development budget. For example, the government could spend only 40% of the Rs 352 billion capital allocations for this year with just a month remaining. It means the performance from the last FY 2023/24 will continue this year as well. Last year, only 58% of the development budget of Rs 302 could be mobilised. These statistics show that while the allocations to development projects are meagre, their utilisation is even weaker.

– Modnath Dhakal

Immediate Past President, Nepal Association of Financial Journalists

How will Nepal’s focus on agriculture and rural development impact urbanisation trends?

Modnath Dhakal: Nepal has been witnessing high internal migration from mountains and hills to Terai and villages to towns and cities. Economic opportunities coupled with education and health facilities have been the major drawing force in internal migration. Focus on agriculture and rural development will create jobs in villages and can slow the migration which will lessen the pressure in urban areas. It will also help to save the fertile land in Terai for agricultural purposes.

However, in its rural and agricultural development initiatives, Nepal should formulate plans for integrated settlements in hills and mountains and implement them with priority in order to reduce the cost of development in education, roads, electricity and water supply, and develop townships to make the local economy more dynamic and vibrant. So, the government must move forward with the plan to develop ten cities along the Mid-Hill Highway to create more economic centres. But the budget is silent on integrated settlements and reducing the cost of development in the hills.

Kuber Chalise: The budget for FY 2025-26 has allocated Rs 57.48 billion for agriculture with due priority to increasing production and productivity. However, the budget allocation for the agriculture sector is only 0.34% more than the current fiscal year’s budget, losing focus on agriculture.

Due to a lack of focus on agriculture and rapid urbanisation, Nepal has experienced a sharp rise in agricultural imports over the past decade, with import value more than doubling from Rs 171 billion in Fiscal Year 2018-19 to over Rs 341 billion in Fiscal Year 2022-23. This upward trend has continued pushing agricultural imports around and above Rs 300 billion by the end of this fiscal year (Fiscal Year ends in mid-July). The surge reflects not only growing domestic demand, limited local production capacity, and increasing reliance on the import of essential food items but also indicates growing dependency leading to a huge trade deficit with agricultural imports making up nearly a quarter of the total import bill. This calls for serious policy reforms, investment in agri-infrastructure and stronger support for domestic producers. Thus, the budget for the next fiscal year, despite spelling out some programmes, fails to address the urgent need. Had the government really focused on agriculture, a quarter of the trade deficit could have been reduced, and Nepal could have achieved food security and helped slow down the rural-to-urban migration, giving breathing space for urban infrastructure development.

Due to the government’s lackadaisical attitude towards a focus on agriculture and rural development, Nepal has witnessed rapid internal migration. According to the National Statistics Office (NSO) data, Nepal’s urban population increased to 27.07% while the rural population declined in a decade between 2011 and 2021. Lack of economic opportunities and limited access to resources in rural areas pushed better employment prospects and improved living conditions in urban areas pulled, the influx of rural-to-urban migration that has put pressure on urban resources and infrastructure. Thus, the government’s focus on rural development could have reversed the trend that would have given much-needed room for better and planned urban infrastructure development.

Sujan Oli: Given Nepal’s supply-side constraints and limited global market access, enhancing productivity in agriculture is almost the only option. Our industrial future also heavily relies on agricultural input-based industries. This is because Nepal cannot realistically compete with neighbouring and industrialised nations in sophisticated manufacturing on a commercial scale. Agriculture can only contribute to rural development if we leverage the existing skills of our rural population for commercial farming and ensure market opportunities for their produce.

Urbanisation is an organic process: as production and industrial sectors expand in rural centres, these can gradually become city centres. This growth needs to be complemented by proper urban planning to foster sustainable urbanisation and contribute to national economic growth.

Bhagwat Bhattarai: Currently, a large portion of our population is still dependent on agriculture, yet agriculture’s contribution to the country’s GDP is less than 25%. Despite a large workforce being involved, the expected benefits from agriculture have not been realised due to low returns. Many have left their farms fallow and migrated abroad or to cities in search of income.

This problem is not unique to Nepal; it is a common issue in many least-developed countries. People naturally seek greater benefits. Therefore, it is essential to demonstrate profitable opportunities in rural areas. While living in a village brings satisfaction, easy access to employment, market access, education and health services are also necessary.

Government programmes aimed at reducing the rural-urban gap can help with this. For example, the objective of the Mid-Hill Highway is to strengthen the rural economy. Along with this, regional cities are expected to develop, supporting balanced urbanisation.

To foster growth in agriculture, animal husbandry and small industries in villages, access to cities is crucial and for this, quality road infrastructure is essential. Therefore, prioritising agriculture and rural development will create employment in villages, make services and facilities more accessible, and reduce pressure on cities, thereby supporting balanced regional development.

One policy reform that Nepal needs today is revenue reforms, under which one key component is a digital taxation system. Digital taxation also means there is no human interface, which will help not only plug the revenue leakage but also formalise the informal economy. Digital taxation also enables the government to tax foreign digital service providers like Google and Netflix and helps formalise the informal digital economy, such as social media sellers and e-commerce vendors.

As of today, around 40% of Nepal’s economy is said to be informal, according to various studies. Digital taxation can bring this huge chunk into the tax net by broadening the tax base, helping the government collect more tax, and more tax collection means, the government can invest more in much-needed infrastructure that can help propel capital formation.

– Kuber Chalise

Consulting Editor, Nepalkhabar

Can we achieve economic diversification with high reliance on tourism and hydropower?

Modnath Dhakal: Nepal’s economy, especially the external sector, is massively supported by remittances. The country is likely to receive above Rs 1.6 trillion remittances this fiscal year and by the end of the 10 months, the country has received Rs 1.35 trillion in remittances. Tourism has significantly contributed to job creation and the development of local economies across the country. However, its income is insufficient to finance Nepalis’ foreign trips for health tourism and education. The export trade is very small with the export of goods worth Rs 200 billion annually which is 9% to 10% of the total imports. To reap benefits from tourism, the country should create several destinations across the country with enough facilities that can hold tourists for several days. Current over-reliance on trekking, mountaineering and trips to the so-called golden triangle of ‘Kathmandu-Pokhara-Chitwan’ should be moderated with the addition of products and expansion of facilities. Drawing high-end Indian and Chinese tourists should be the priority.

Although the government and private sector have long been placing emphasis on tourism sector development, budget allocation is rather low. Development of religious circuits and tourism, adventure and eco-tourism is yet to gain momentum.

Energy, on the other hand, can yield two-pronged benefits – helping businesses and industries in the country and earning foreign currency by exporting electricity and saving it by substituting the import of fossil fuels. Development of energy infrastructure has also helped to build roads and other facilities up to the project sites which often are in the remote areas and mountains, thus, creating economic opportunities for the local communities. The government has allocated about Rs 86 billion to the energy and irrigation sector for 2025/26 with emphasis on large and reservoir-based hydropower projects, and transmission lines. Public-private partnerships, electricity export to India and Bangladesh and increasing energy are positive approaches announced by the budget. If Nepal needs further diversification, ICT, agricultural processing, forest-based products and health have high potential.

Kuber Chalise: With the two manufacturing powerhouses, India and China by its side, Nepal has limited areas for economic growth. Tourism and hydropower are two sectors that can lead Nepal to growth without competing with these two economic superpowers. At the same time, the reliance on hydropower could help economic diversification, as enough power can open a plethora of opportunities in various sectors. The only condition is, that the government must have a stable policy.

Energy is not only the driver of growth but has also become a basic need for any of the economic activities. Enough energy, through hydropower that is clean energy, can help Nepal get much-needed fund also in the form of carbon compensation. However, the government must focus on quality infrastructure for tourism and hydropower for economic diversification and sustainable growth. These two sectors also create employment, from unskilled to highly skilled, a lack of which has resulted in an outflux of youth in recent years.

Sujan Oli: Nepal, strategically positioned between the world’s most populous nations, India and China, possesses inherent advantages. Its maintained neutrality with these giants, coupled with a favourable climate in an era of global warming, and countless diverse tourist destinations – from mountaineering and adventure to heritage, cultural, flora/fauna observation, and peaceful holidays – offer immense potential for unlimited tourism growth.

Impressively, significant investment has flowed into Nepal’s tourism infrastructure, particularly hotels and accommodation, with a rising number of global brands entering the market. Nevertheless, Nepal must still invest in connectivity via roads, air and water transportation, and develop luxury infrastructure capable of attracting high-value tourists inclined to longer stays.

Hydropower in Nepal certainly holds great potential, yet it faces considerable risks from climate change, including the possibility of glacial lake outburst floods (GLOFs), altered discharges in glacier-fed rivers, and seismic activities. Beyond the highly publicised export potential, Nepal has a substantial appetite for clean energy for decades to come, crucial for industrialisation, urbanisation and enhancing citizens’ quality of life.

Bhagwat Bhattarai: Both tourism and hydropower are crucial pillars of Nepal’s economy but the expected benefits have not been realised. An adequate ecosystem for tourism has not been prepared. With two neighbouring countries being the world’s second and fifth largest economies, it is difficult for Nepal to compete in manufacturing. In such a situation, Nepal needs to focus on the service sector.

Tourism can contribute to employment, revenue and foreign exchange earnings. However, this requires security, quality services, cleanliness and infrastructure development. Nepal has ample natural, cultural and historical destinations that need promotion and systematic management. Tourism can be diversified by expanding infrastructure in scenic rural areas.

Hydropower is an area where Nepal has a comparative advantage. Its production has increased significantly in the last 10 years. However, we are trapped in a dilemma: electricity shortages during the dry season and overproduction during the rainy season, but with challenges in export.

Conditions for exporting electricity to India are strict. Even though a new market has opened in Bangladesh, it also depends on transit through India. The government still holds a monopoly in electricity trade and the private sector has not been given sufficient opportunities.

The government needs to adopt a clear energy policy. If large debts are incurred for infrastructure development with low returns, the risk increases. Therefore, the private sector should be involved in energy trade, opening the way for sustainable economic diversification.

Nepal must move beyond the conservative policy-making notion that all significant investments for large construction and social welfare projects should solely originate from the government. Policies must be devised and implemented to attract private investment through globally recognised instruments such as blended finance, public-private partnerships, impact funds, and venture capital funds. Nepal can only achieve economic dynamism by fully activating the Fiscal Federal architecture envisioned by its constitution. The more municipal governments comprehend their rights and duties in economic planning, resource management and project implementation, the better the economic outcomes will be in terms of productivity, inclusion and sustainability.

– Sujan Oli

President, Society of Economic Journalists-Nepal

Is the push for digital taxation and revenue reforms a step toward a modern economy or a potential risk for SMEs?

Modnath Dhakal: Digital taxation is a welcome step as it will help the taxpayers and reduce the cost of compliance. The budget for FY 2025/26 expands the use of e-billing and integrated tax system. However, it could not announce significant steps for revenue reforms save a few changes in tax rates. The tax base could not be expanded although discounts and adjustments were made for startups, cement industries and the non-filers. It also failed to hike excise duties on tobacco, cigarettes and alcoholic products.

Some of the major reforms in taxation are the abolishment of advance tax collection at customs points, removal of filing minimum tax by the taxpayers with no transactions, five-year income tax exemption for production and assembly of electric vehicle charging machines, and customs duty waiver for green hydrogen, and natural and organic fertiliser industry equipment.

Although there are apprehensions about the complexities in tax compliance for SMEs, the digital system would make it easy and less costly. There also are overregulation risks. So, special initiatives in capacity building and financial/digital literacy for SMEs should be implemented jointly by the public and private sectors. Establishing a taxpayer support centre could be the first step towards achieving this goal.

Kuber Chalise: One policy reform that Nepal needs today is revenue reforms, under which one key component is a digital taxation system. Digital taxation also means there is no human interface, which will help not only plug the revenue leakage but also formalise the informal economy. Digital taxation also enables the government to tax foreign digital service providers like Google and Netflix and helps formalise the informal digital economy, such as social media sellers and e-commerce vendors.

As of today, around 40% of Nepal’s economy is said to be informal, according to various studies. Digital taxation can bring this huge chunk into the tax net by broadening the tax base, helping the government collect more tax, and more tax collection means, the government can invest more in much-needed infrastructure that can help propel capital formation.

Likewise, revenue reform can help the government achieve its missing revenue target. For the next FY 2025-26, the government has targeted to collect Rs 1.315 trillion revenue, as part of its total budget of Rs 1.964 trillion.

In the current FY 2024–25, revenue collection has shown moderate growth but remains below target. As of June 13, the government has collected Rs 1.013 trillion in revenue, approximately 72% only of the annual revenue target of Rs 1.419 trillion, out of which except for non-tax and grant, Rs 1.284 trillion is the tax collection target.

Thus, revenue reform can significantly improve revenue collection by broadening the tax base, and also to include growing digital platforms and online businesses.

Digital taxation, under revenue reform, will not only enhance transparency and compliance through real-time monitoring, digital invoicing, and e-filing systems but also reduce tax evasion, improve administrative efficiency, and ensure more accurate and timely revenue collection, ultimately strengthening Nepal’s fiscal capacity.

Likewise, digital taxation, if well-tailored to suit SMEs can help empower them by encouraging formalisation, improving competitiveness, and expanding public support systems. If the government fails to tailor digital taxation to suit SMEs, it could risk SMEs’ growth due to compliance burdens and rising costs, also. Thus, digital literacy, less regulation, more support and incentives to ensure a level playing field for local SMEs should be better thought of, with government’s investment in better digital infrastructure and services to maximise the benefit.

Sujan Oli: It is largely a question of policy calibration. If scientific and progressive tax policies are implemented, with more focus on direct taxes than indirect ones, SMEs need not worry much. There is no alternative to completely digitising the tax administration even to control massive leakages in the system. It is more of an issue of governance than the adoption of state-of-the-art technology including digitisation.

Bhagwat Bhattarai: A digital tax system is essential. It helps improve revenue collection and facilitates the transition towards a modern economy. However, without the necessary preparation and digital literacy, its implementation could pose difficulties for small and medium-sized enterprises (SMEs).

In recent years, the government has promoted a ‘faceless’ tax system but its implementation has not been effective. The government server system is weak, and taxpayers lack the necessary knowledge and training. A digital tax system should be beneficial for SMEs, reducing costs and bringing transparency to processes. However, due to a lack of preparation, it has instead led to confusion and the need for additional manpower. Therefore, before implementing a digital tax system, it is crucial to strengthen the infrastructure, develop a taxpayer-friendly system, and prioritise digital literacy.

Infrastructure alone is not a sufficient basis for sustainable economic development. If the built infrastructure cannot be utilised, it can lead to reverse damage, an example of which we have already observed in Sri Lanka. Along with infrastructure, the development of skilled human resources, technology and a favourable environment for enterprises is also necessary. Infrastructure investment fulfills the minimum condition for improving living standards.

– Bhagwat Bhattarai

Economic Correspondent, Setopati

How can businesses, government and citizens collaboratively ensure that the fiscal policies not only drive short-term recovery but also lay the groundwork for a sustainable and inclusive economic future?

Modnath Dhakal: In the context of the sustained failure to achieve both the short-term recovery as well as long-term development goals in Nepal, joint efforts from all stakeholders of the economy could offer a solution. If we could move ahead with clear goals and responsibilities for transparency, accountability, equity and development for the government, private sector and citizens, the country can make a couple of strides in economic growth and prosperity.

In every sense, nation-building is a collaborative effort that demands active participation from business, government and citizens. For this, these three stakeholders should collaborate in education and skills, tax reforms, sustainable infrastructure development and environment-friendly business practices. The government’s role is crucial in policy making, taking up development works, and offering incentives while the private sector’s duty is investment, compliance and innovation. Citizens should change their behaviour in favour of national development and support domestic products.

Kuber Chalise: The government and private sector must move hand-in-hand for a sustainable and inclusive economic future. The government, with less interference and regulations, must craft transparent, equitable and clear policies that can support private sector growth. According to a joint report by the International Finance Corporation (IFC) and the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), the private sector contributes approximately 81.55% to Nepal’s GDP.

It also claims that 85.6% of the total labour force, equivalent to around 4.93 million, are employed in private enterprises such as micro, small and medium enterprises (MSMEs) and large industries. Furthermore, the sector accounts for about 87% of intermediate consumption and 83% of GDP at constant prices, reflecting its strong production and economic output. Thus, the strong private sector is not only the backbone of economic growth but also a major source of employment and investment in Nepal. Strengthening the private sector is crucial for sustaining economic development, reducing unemployment, and fostering inclusive growth.

Likewise, the private sector should also act responsibly by paying fair taxes, investing in innovation, and adopting sustainable practices that boost productivity and job creation.

In this context, the citizens also play a crucial role by complying with laws, holding political parties accountable, and supporting local businesses. Thus, to make a fiscal policy a powerful tool for short-term recovery and long-term resilient and fair economy, the government, private sector and citizens, especially the political parties should be more responsible.

The government has brought the budget for the next fiscal year on Jestha 15, as prescribed by the Constitution. However, the coalition government of two major political parties, Nepali Congress and CPN-UML, has lost the opportunity to bring about the key second-generation reforms and propel Nepal towards a robust economy also due to their ideological dilemma. The government’s apathy towards a policy shift and addressing the structural problem in Nepal’s economy will cost the country dearly. And it will be remembered as ‘Politics pushing the Economy to the back seat again’.

Sujan Oli: Nepal must move beyond the conservative policy-making notion that all significant investments for large construction and social welfare projects should solely originate from the government. Policies must be devised and implemented to attract private investment through globally recognised instruments such as blended finance, public-private partnerships, impact funds, and venture capital funds. Nepal can only achieve economic dynamism by fully activating the Fiscal Federal architecture envisioned by its constitution. The more municipal governments comprehend their rights and duties in economic planning, resource management and project implementation, the better the economic outcomes will be in terms of productivity, inclusion and sustainability. Both the policy ecosystem and the federal administrative architecture must function in tandem to foster a growth-oriented and sustainable economy. Only by first enlarging the economic ‘pie’ and then ensuring its judicious distribution can an inclusive economic model be built.

Bhagwat Bhattarai: In this regard, a significant gap is evident between the government, businesses and citizens. The main weakness appears in the government’s policymaking process.

There is a lack of clarity regarding the purpose behind government policies. This situation is a result of insufficient discussion and preparation in the formulation of financial and tax policies. Consequently, continuous revisions to policies create an unstable business environment and increase public dissatisfaction.

For the promotion of small and medium-sized enterprises, it is crucial to facilitate cash flow, provide tax exemptions for a limited period, offer subsidised loans for the purchase of industrial infrastructure, and allow investment returns to be paid in instalments over a long period.

By ensuring the participation of stakeholders in the policymaking process, a foundation for a trustworthy, sustainable and inclusive economy can be established.