The government has unveiled a comparatively moderated budget for FY 2025/26, diverging from expectations of an inflated budget seen in previous years. For the third time, Deputy Prime Minister and Finance Minister, Bishnu Prasad Paudel, presented the budget in Parliament emphasizing that it prioritises allocative efficiency, stability and effective implementation. The budget, totaling Rs 1,964.11 billion, marks a 5.58% increase from the prior budget and represents approximately 30% of the national GDP. (See Table 1)

Table 1: Comparative figures of budget 2024/25 and 2025/26

|

Fiscal Year/Budget |

FY 2024/25 |

FY 2025/26 |

Difference in % |

Share % in total budget |

|

Total budget (in Rs bn) |

1860.3 |

1964.11 |

5.58 |

100.0 |

|

Recurrent expenses |

731.79 |

763.15 |

4.28 |

38.85 |

|

Capital expenditure |

352.35 |

407.89 |

15.76 |

20.76 |

|

Financing provision |

367.28 |

375.24 |

2.16 |

19.1 |

|

Grants to sub-national governments |

408.87 |

417.83 |

2.19 |

21.27 |

|

Source of financing (Rs in billion) |

||||

|

Revenue target |

1260.30 |

1315 |

4.34 |

66.95 |

|

Foreign grant |

52.33 |

53.45 |

2.14 |

2.72 |

|

Foreign loan |

217.67 |

233.66 |

7.34 |

11.89 |

|

Domestic debt |

330 |

362 |

9.69 |

18.43 |

Unrealistic resource mapping

The government is struggling with a resource crisis when it comes to budget financing. Experts say the resource assumptions are simply unrealistic. Compared to last fiscal year’s resource mapping, the government has increased its revenue target by 4.34%, foreign loan by 7.34%, and grants by 2.14%. The primary reliance is on domestic debt, which has increased by almost 10% from Rs 330 billion to Rs 362 billion.

According to Dr Prakash Sharan Mahat, Former Finance Minister, “The resource estimation presented by the budget is unrealistic as foreign grants and loans are shrinking.” He said, “ I personally believe that we should not opt for bilateral loans considering the interests and conditions.”

Dr Mahat further noted that the government’s target to mobilise a high amount of domestic debt would lead to a crowding out effect in the economy. He questioned, “If the government is raising a high amount of debt, then where will the private sector avail funds for their business?” This unrealistic estimation ultimately impacts discretionary expenses, particularly capital expenditures, because the government cannot reduce mandatory (committed) expenses.

The government acknowledged these resource constraints during budget formulation and adjusted spending accordingly. For instance, it raised the eligible age for social security allowances from 68 to 70 years. (See Table 2)

Table 2: Major Spending

|

Major spendings (Recurrent expenses) |

Amount (Rs in bn) |

|

Fiscal transfer to provinces and local level |

417.82 |

|

Allowance and perks of civil servants |

180.14 |

|

Social security expenses |

147.28 |

|

Grant to government agencies, committees and boards |

129.86 |

|

Pensions, gratuities and other social benefit of civil servants |

113.79 |

|

Interest expenses of domestic debt |

92.96 |

|

Interest expenses of foreign debt |

15.57 |

|

Road and bridges |

159.82 |

|

Vehicles and machinery |

19.85 |

|

Monitoring, evaluation and travel expenses |

3.46 |

|

Miscellaneous |

1.53 |

|

Consultancy procurement |

13.63 |

|

Capital expenses improvement |

2.8 |

|

Maintenance of structures |

1.47 |

|

Utility tariffs |

4.52 |

|

Training and workshops |

3.15 |

|

Office logistics and services |

4.68 |

|

Rental expenses |

2.57 |

|

Unforeseen liabilities |

9.70 |

Credibility Concerns

Unrealistic resource estimates have sparked concerns about the budget’s credibility. “When resource estimations are unrealistic, we can’t trust its proper implementation,” stated Swarnim Wagle, a Member of Parliament and seasoned economist. He added, “Fiscal policy is losing its credibility due to a lack of proper implementation, leading stakeholders to overly rely on monetary policy.”

Among these two branches of economic policy, fiscal policy plays a more significant role in energising the economy. Typically, as the largest procurer of goods and services, government spending prompts investment mobilisation from the private sector.

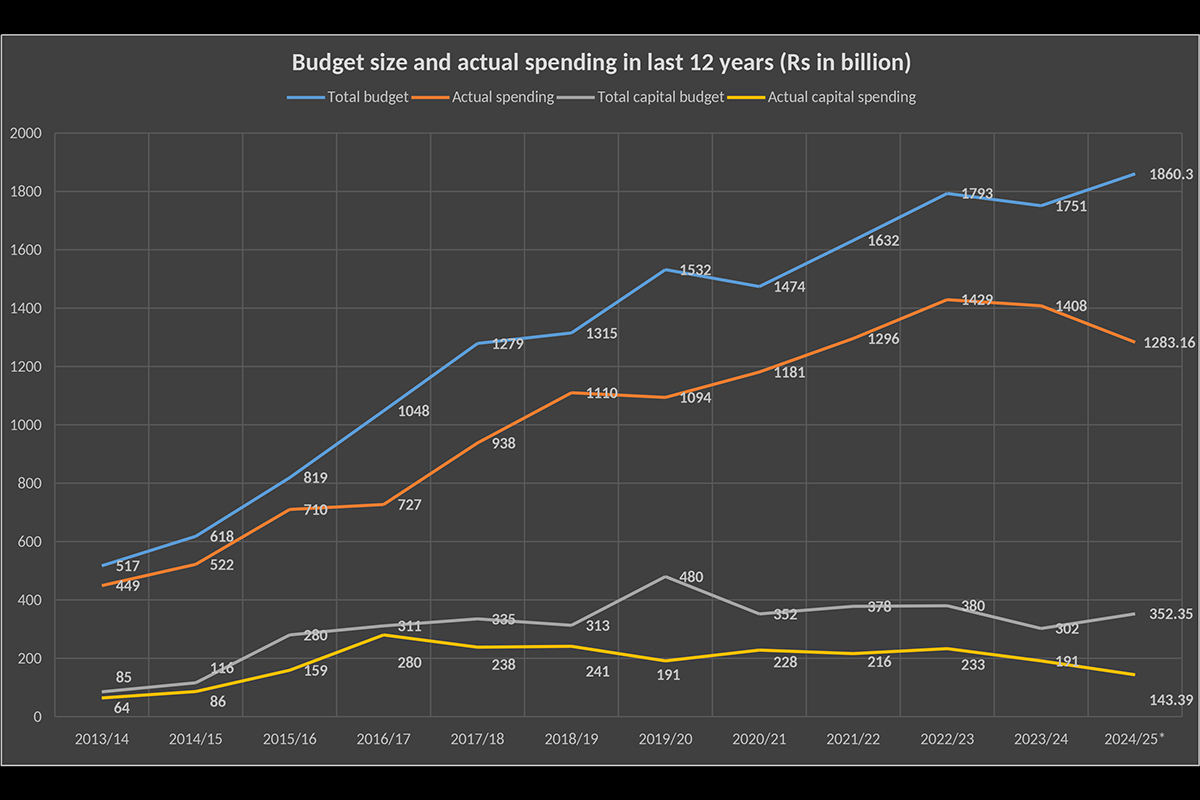

Nara Bahadur Thapa, an economist and former Executive Director of Nepal Rastra Bank, highlighted that the Ministry of Finance’s practice of revising the budget midway through the fiscal year without parliamentary approval is a serious deviation that needs to stop. “The government should execute the budget endorsed by the parliament without any distortion,” Thapa asserted, adding, “The parliament must hold the government accountable for it without any excuses.” Thapa further emphasised that the budget revolves around allocative efficiency, implementing capacity and accountability. “These three crucial components are lacking in our budgetary system, which not only affects credibility but also triggers fiduciary risks,” he said. As an example, he cited capital expenditures in the ongoing fiscal year. Initially, Rs 352.35 billion was allocated but the mid-term review lowered the target to Rs 299.5 billion. Actual capital expenditure as of mid-June – just a month before the fiscal year’s close – appears to be far below the revised target, at merely Rs 143.39 billion.

Budget size and actual spending in last 12 years (Rs in billion)

What the budget envisions for implementation and resource arrangements

The fiscal budget for 2025/26 has outlined several measures to ensure effective budget implementation, emphasising allocative efficiency and fiscal discipline as key tools for improving public finance management (PFM).

The budget announced plans to strengthen cash flow management for the federal consolidated fund, ensure the productive use of public debt, and execute national fiscal management. It also anticipates the parliamentary endorsement of the Alternative Development Finance Bill, which would enable capital mobilisation from various sources, including domestic and foreign private sector investment, for infrastructure and industrial development. Furthermore, the fiscal budget states that the government will introduce standards for national pride projects.

Crucially, the government has eliminated 4,654 piecemeal projects and set a benchmark for federal government projects and programmes, requiring an earmark of no less than Rs 30 million. The fiscal budget also stipulates that the procurement process will only begin after preparatory background work, such as land acquisition and forest clearance, is complete. It will also hold the line ministry accountable for capital expenditure.

The fiscal budget has also emphasised amending Public Procurement Laws and enhancing the e-bidding system to accelerate development projects. This aims to ensure transparency and legal adherence in procurement-related dispute resolution.

It has provided guidance to subnational governments, directing them to formulate budgets based on the medium-term expenditure framework (MTEF). The fiscal budget for 2025/26 prohibits fund transfers except for national pride projects and highly prioritised projects under specific conditions.

Additionally, the budget announced the introduction of a project monitoring dashboard to track the progress of major projects exceeding Rs 250 million. The fiscal budget prioritises ‘low-hanging fruit’ projects, stating that those having achieved 80% progress will be expedited for completion with adequate resources.

Encroachment on Monetary Policy’s jurisdiction

The fiscal policy has been criticised for encroaching on the monetary policy’s jurisdiction by announcing programmes typically implemented through monetary measures. Previously, the fiscal policy announced loans against academic certificates, which proved ineffective. Additionally, the fiscal budget for 2025/26 has introduced multiple schemes, including loan rescheduling, working capital provisions, and relaxations in interest and penalties, reportedly to boost business confidence.

Ideally, monetary and fiscal policies should complement each other, meaning their orientations should align; for example, a contractionary fiscal policy could be balanced by an expansionary monetary policy. Conversely, if the budget is expansionary, monetary policy should be contractionary to mitigate the adverse effects of increased money supply and inflationary pressure. However, the current approach of the fiscal policy, which announces potential monetary measures and compels Nepal Rastra Bank to implement schemes outlined in the budget, is seen as an encroachment on monetary policy and the central bank’s autonomy.

Reform of public enterprises

The budget has announced reforms for state-owned enterprises (SOEs), also known as public enterprises, through changes in their governance and investment frameworks. These reforms include privatisation by onboarding strategic partners, divestment of shares, and operation under a public-private partnership modality (brownfield investments). It also proposes bringing SOEs with similar objectives under a holding company structure.

Furthermore, public enterprises that lack a rational purpose or are not in operation will be liquidated, unless they demonstrate potential for revival. The budget specifically announced the divestment of 30% of Nepal Telecom’s shares to the public.

Fiscal transfer to subnational governments

Based on the National Natural Resources and Fiscal Commission (NNRFC)’s recommendation, the federal government has transferred Rs 60.66 billion to provinces and Rs 88.97 billion to local levels as equalisation grants. Additionally, Rs 241.81 billion has been allocated under conditional grants – comprising Rs 30.35 billion for provinces and Rs 211.46 billion for local levels.

Furthermore, Rs 3.28 billion and Rs 10.6 billion have been transferred as matching grants to provinces and local levels, respectively. An additional Rs 3.27 billion for provinces and Rs 9.78 billion for local levels has been provided under special grants. The federal budget estimates that revenue sharing from the federal divisible fund will amount to Rs 165 billion in Fiscal Year 2025/26. (See Table 3 and 4)

Table 3: Fiscal Transfer to Local Levels (Rs in bn.)

|

Local levels |

Numbers |

Equalisation |

Conditional |

Special |

Complementary |

Recurrent |

Capital |

Total |

|

Metropolitan cities |

6 |

2.72 |

8.88 |

0.8 |

0.4 |

9.67 |

2.07 |

11.74 |

|

Sub metropolitan cities |

11 |

3.09 |

7.89 |

0.19 |

0.19 |

9.74 |

1.63 |

11.38 |

|

Municipalities |

276 |

38.30 |

97.18 |

3.77 |

3.84 |

119.63 |

23.46 |

143.10 |

|

Rural Municipalities |

460 |

44.83 |

97.49 |

4.53 |

5.97 |

134.77 |

19.25 |

154.02 |

|

Total |

753 |

88.96 |

211.45 |

8.5 |

10.06 |

273.83 |

46.43 |

320.26 |

Source: Intergovernmental fiscal transfer 2025/26, Ministry of Finance

Table 4: Fiscal Transfer to Provinces (Rs in bn.)

|

Provinces |

Equalisation |

Conditional |

Special |

Complementary |

Recurrent |

Capital |

Total |

|

Koshi |

8.98 |

4.57 |

0.55 |

0.39 |

11.91 |

2.59 |

14.50 |

|

Madhesh |

7.72 |

4.26 |

0.39 |

0.35 |

10.22 |

2.51 |

12.73 |

|

Bagmati |

8.28 |

4.89 |

0.40 |

0.23 |

11.04 |

2.77 |

13.81 |

|

Gandaki |

7.73 |

3.35 |

0.49 |

0.63 |

9.91 |

2.31 |

12.23 |

|

Lumbini |

8.44 |

4.66 |

0.40 |

0.51 |

11.35 |

2.66 |

14.01 |

|

Karnali |

10.56 |

4.44 |

0.49 |

0.53 |

12.47 |

3.56 |

16.04 |

|

Sudurpashchim |

8.92 |

4.16 |

0.51 |

0.60 |

11.17 |

3.03 |

14.20 |

|

Total |

60.66 |

30.35 |

3.26 |

3.28 |

78.11 |

19.44 |

97.56 |

Source: Intergovernmental fiscal transfer 2025/26, Ministry of Finance

Major Amendments in Revenue

The government aims to collect Rs 1,480 billion in revenue in the upcoming fiscal year, which includes revenue to be shared with subnational levels from the divisible fund. Fifteen percent of the Value Added Tax (VAT) and internal excise are shared with provinces and local levels from this fund.

Former Finance Minister, Barsha Man Pun, has accused the government of unduly favouring the private sector through minimal tax revisions. Even major revenue sources like automobiles, tobacco and alcohol products will see stable tax rates. “It is a herculean task for the government to achieve the revenue target without making rational revisions to the rates for major tax contributors and broadening the tax net,” he stated. However, Deputy Prime Minister and Finance Minister, Paudel, has asserted that he has not made significant changes in order to provide stability and predictability to a private sector shattered by the Covid 19 pandemic and still struggling to revive. (See Table 5, 6, 7 and 8)

Table 5: Commodity and services

|

Commodity and services |

Tax category |

Previous rate |

Revised rate by 2025/26 |

|

MS wire and rods |

Customs |

5% |

10% |

|

Clearing houses and electronic transactions |

VAT |

13% |

- |

|

Coal and coal-based products |

Green tax (levy) |

- |

50 paisa per kg |

|

Petroleum |

Green tax (levy) |

- |

Rs 1 per liter |

|

Lubricants and mineral oils |

Green tax (levy) |

- |

1% |

|

Gold ornament (on sales of more than one million) |

Luxury tax |

- |

2% |

|

Export of IT services (in an individual effort) |

Individual Income tax |

n/a |

5% |

|

Export of IT services (from IT firms established in IT parks) |

Income tax |

50% waiver |

75% waiver |

|

Startups (having annual transactions up to Rs 100 million) |

Income tax |

- |

100% waiver for five years |

(Source: Financial Act, 2025/26)

Table 6: Excise in Liquor

|

Import price (in Rs) |

Previous provisions (Per liter) |

Provisions of budget FY 2025/26 |

Interpretation |

|

>2,000 |

Rs 2,000 |

Rs 2,000 |

No less than Rs 2,000 and maximum 100% of the import value |

|

<2,000 |

Rs 2,000 |

100% of the import value |

|

|

Wine (remain less than Rs 300 while slapping 80% customs tariff) |

Rs 300 |

Rs 300 |

No less than Rs 300 and maximum 80% of the import value |

|

Wine (remain more than Rs 300 while slapping 80% customs tariff |

Rs 300 |

80% of the import value |

|

|

Beer (remain less than Rs 200 while slapping 80% customs tariff) |

Rs 200 |

Rs 200 |

No less than Rs 200 and maximum 80% of the import value |

|

Beer (remain more than Rs 200 while slapping 80% customs tariff) |

Rs 200 |

80% of the import value |

(Source: Financial Act, 2025/26)

Table 7: Income Tax

|

Existing Provision |

Revised Provision |

|

Contribution based retirement payment means • Amount deducted monthly from the salary of an employee and • Employer’s contribution deposited in approved retirement fund • This also includes the incremental amount in such contribution. • If a resident person desires to establish a retirement fund, it should file an application to IRD and IRD shall give approval as prescribed. • No provisions |

Contribution based retirement payment means • Amount contributed to an approved retirement fund after being included in the income of a natural person • This also includes an incremental amount in such contribution. • Removed

For Section 63 of Income Tax Act 2058, approved retirement fund’ means • Employee Provident Fund established under the Employee Provident Fund Act, 2019 • Citizen Investment Trust established under Citizen Investment Trust Act, 2047 • The retirement fund operated by the social security fund established pursuant to the Contribution Based Social Security Fund Act, 2074 and • The retirement fund operated by the pension fund established pursuant to the Pension Fund Act, 2075. |

Table 8: Advance (Income) tax

|

Particulars |

Rate – FY 2025/26 |

|

Advance tax is to be collected by resident banks and financial institutions that provide foreign currency exchange facilities for language and examination fees to students pursuing studies abroad. This collection will occur at the time of providing the foreign currency exchange facility for such examination fees. |

15% |

|

Advance tax is to be collected by concerned banks, financial institutions and money transfer services on payments of foreign currency received by a natural resident person for providing software or similar electronic services outside Nepal (when not conducted through business operations). |

5% |

|

Advance tax is to be collected by concerned banks, financial institutions and money transfer services on payments of foreign currency received by a natural resident person for providing consultancy services outside Nepal (when not conducted through business operations). |

5% |

|

Advance tax is to be collected by concerned banks, financial institutions and money transfer services on payments of foreign currency received by a natural resident person for uploading audio-visual material on social networks (when not conducted through business operations). |

5% |

|

Advance tax is to be collected by resident e-commerce operators on payments made to individuals for the sale of goods, services or combined goods and services provided through their platforms. |

1% |

|

Advance tax is to be collected by the customs department on the import of the following categories of goods: Group 1/2/3/6/7/8 of Customs Tariff: This includes meat (with or without bones), live and fresh fish, fresh flowers, edible vegetables and certain roots and tubers, and edible fruits, nuts and other produce. Group 4/10/11/12/14 of Customs Tariff: This covers milk products, eggs, honey, millets, phapar, junelo, rice, kanika, flour, herbs, sugarcane and various vegetable products. Group 4/10/11/12/14 of Customs Tariff: This covers milk products, eggs, honey, millets, phapar, junelo, rice, kanika, flour, herbs, sugarcane and various vegetable products. However, for goods on which VAT is applicable, a specific advance tax rate will apply. |

10% 2.50% 1.50% |

FNCCI Overwhelmed by Significant Policy Tweaks

The Federation of Nepalese Chambers of Commerce and Industry (FNCCI) has lauded the budget citing its commitment to economic reform and its recognition of the private sector as a catalyst for development. According to FNCCI, the budget incorporates their feedback, ensuring predictable policies and the non-enforcement of retrospective laws. While acknowledging a partial address of the one-stop service for entrepreneurs, FNCCI suggested that the digitalisation of services would yield more effective results.

FNCCI hailed the budget’s announcement of reforms across various laws, including the Public Private Partnership and Investment Act, dues recovery law, and the simplification of forest and environment rules and regulations, all aimed at developing Nepal as a globally favourable investment and tourism destination. FNCCI also applauded the provision of equal treatment for the hospitality sector akin to the ICT sector, the minimisation of rent in Special Economic Zones (SEZs) and industrial estates, and equivalent treatment for industries operating outside SEZs that export 30% of their total production. Furthermore, FNCCI commended the promotion of the Fourth Industrial Revolution (Industry 4.0) to boost production through cutting-edge technologies.

While FNCCI anticipates increased investment flow in the hospitality sector with this recognition, they caution that the continuation of the 13% VAT on airline tickets will keep Nepal an expensive destination. It further stated that the new schemes for operating the two new international airports are praiseworthy and urged for the early completion of the envisioned Kathmandu-Terai Fast Track.

FNCCI has drawn the government’s attention to the potential discouragement of private sector investment due to the ‘take and pay’ policy in power purchase agreements. They urged the government to correct this to ‘take or pay’, which historically supported energy sector development by attracting both foreign and domestic private sector investment.

According to FNCCI, startups and innovation are another domain specifically addressed by the budget 2025/26. They highlighted several remarkable moves, including entrepreneurship promotion focusing on Gen Z, establishing incubation centres in collaboration between the private sector and universities, incentivising innovation-based startups through interest subsidies, providing an income tax waiver for startups with annual transactions of up to Rs 100 million for five years, and waiving registration fees for women entrepreneurs registering their businesses. FNCCI welcomed the announced collaboration between the government and private sector in various sectors, including the establishment of IT parks, the adoption of software, and research and use of AI and machine learning, among others.

FNCCI is reportedly overwhelmed by significant policy tweaks such as the move towards creeping capital account convertibility from a position of restricting investment abroad. Henceforth, the government has allowed exporters to invest up to 25% of their export value, however, they must repatriate 50% of the profit from ventures operated outside the country.

FNCCI has stated that the growth target set by the fiscal budget is not ambitious and that 6% growth is achievable if the budget is implemented effectively, coupled with reforms in governance and investment protection.

Balanced Budget, Encouraging For The Production Sector: CNI

According to the Confederation of Nepalese Industries (CNI), the fiscal budget 2025/26 includes enabling provisions to attract private sector investment. CNI stated, “Budget is balanced and has given priority to the private sector for propelling growth, creating jobs and boosting production.”

The decision to reduce rent in Special Economic Zones (SEZs) from Rs 20 per square metre to Rs 5, along with a 50% deduction in rent for industrial estates, is highly praised. Similarly, industries outside SEZs that export 30% of their production will receive comparable facilities. CNI has applauded the move to motivate startups, establish incubation centres in collaboration with the private sector and universities, and implement tax cuts (75%) on ICT exports for firms, with only a 5% income tax levied on individuals exporting ICT services. The budget’s plan to develop industrial estates in Shaktikhor and Mayurdhap under a public-private partnership (PPP) model was also welcomed.

CNI hailed the provision allowing Nepali businesspersons or firms to establish sales counters or processing plants in foreign countries and to invest 25% of their total export earnings abroad. As the budget envisions developing blacktopped roads with RCC concrete, sand, aggregates, cement and rods; preparing detailed project reports (DPR) for broad gauge rail; and planning cities in seven provinces, CNI is optimistic about a significant leap in the manufacturing, construction and tourism industries, moving the economy away from its current stagnation. They also anticipate that the upcoming monetary policy might simplify working capital loans as envisioned by the budget. CNI noted that simplifications in Environmental Impact Assessment (EIA) and forest rules, among others, will accelerate development activities to some extent. However, CNI expressed doubt regarding the proper implementation of the budget, given the weak trend of budget execution in the past.

According to CNI, Nepal can become a hub for data centres if it provides uninterrupted power supply and a serene environment for remote workers with a Digital Nomad Visa. “Promoting PPP, private equity and venture capital, bond market development, and other potential financing will leverage investment, including from government-owned non-banking financial institutions such as the Employees Provident Fund and Citizen Investment Trust.”

CNI also applauded several other announcements: licensing hedging services; formulating dues recovery laws; developing 100,000 units of buildings and apartments nationwide targeting civil servants, teachers, and security personnel; removing VAT on digital transactions; scrapping advance income tax on imported dairy products collected at customs points; eliminating the bank guarantee requirement to obtain an EXIM code; and abolishing the mandatory minimal tax file for companies without taxable incomes. These measures, combined with capacity enhancement and governance reforms, particularly in tax administration for providing simplified services to customers, were highly commended.

-1765706286.jpg)

-1765699753.jpg)