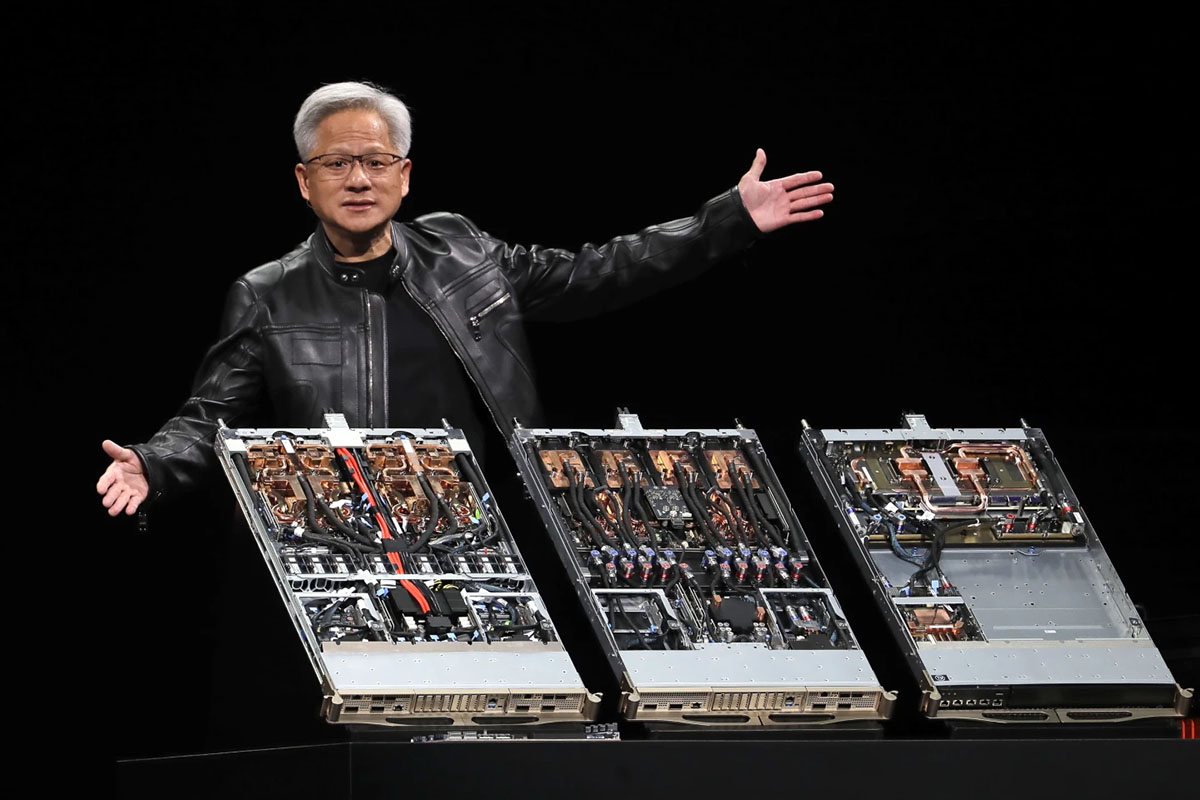

BANGKOK: Nvidia’s CEO Jensen Huang says the technology giant has won approval from the Trump administration to sell its advanced H20 computer chips used to develop artificial intelligence to China.

The news came in a company blog post late on Monday, which stated that the US government had ‘assured’ Nvidia that licences would be granted — and that the company ‘hopes to start deliveries soon.’ Shares of the California-based chipmaker were up by over 4% by midday on Tuesday.

Huang also spoke about the coup on China’s state-run CGTN television network, in remarks shown on X.

‘Today, I’m announcing that the US government has approved us filing licences to start shipping H20s,’ Huang told reporters in Beijing.

He added that half of the world’s AI researchers are in China. ‘It is so innovative and dynamic here in China that it is really important that American companies are able to compete and serve the market here,’ he said.

Huang recently met with President Donald Trump and other US policymakers and is in Beijing this week to attend a supply-chain conference and speak with Chinese officials. The broadcast showed Huang meeting with Ren Hongbin, the head of the China Council for the Promotion of International Trade, host of the China International Supply Chain Expo, at which Nvidia was exhibiting.

Nvidia has profited enormously from the rapid adoption of AI, becoming the first company to have its market value surpass $4 trillion last week. However, the trade rivalry between the US and China has weighed heavily on the industry.

Here is what we know.

What is Nvidia’s H20 chip?

The H20 graphics processing unit, or GPU, is an advanced AI chip — a device used to build and update a range of AI systems. But it is less powerful than Nvidia’s top semiconductors today.

That is because the H20 chip was developed to comply with US export restrictions for AI chips to China. Nvidia’s most advanced chips, which carry more computing power, are off-limits to the Chinese market.

Washington has been tightening controls on exports of advanced technology to China for years, citing concerns that know-how intended for civilian use could be deployed for military purposes. In January, before Trump began his second term, President Joe Biden’s administration launched a new framework for exporting advanced computer chips used to develop AI — an attempt to balance national security concerns with the economic interests of producers and other countries.

Restrictions on sales of advanced chips to China have been central to the AI race between the world’s two largest economic powers, but such controls are also controversial. Proponents argue these restrictions are necessary to slow China down enough to allow US companies to maintain their lead. Meanwhile, opponents say the export controls have loopholes and could still spur innovation. The emergence of China’s DeepSeek AI chatbot in January particularly renewed concerns over how China might use advanced chips to develop its own AI capabilities.

What has happened since Trump took office?

In April, the White House announced it would restrict sales of Nvidia’s H20 chips to China — as well as MI308 chips from rival chipmaker Advanced Micro Devices — with the Trump administration again citing national security.

At the time, Nvidia said these tighter export controls would cost the company an extra $5.5 billion — and Huang and other technology leaders had been lobbying Trump to reverse the restrictions since. They argued such limits hinder US competition in one of the world’s largest markets for technology, and warned US export controls could push other countries towards China’s AI technology.

Monday’s announcement from Nvidia signals its lobbying efforts paid off. White House AI and crypto adviser David Sacks told Bloomberg on Tuesday that allowing Nvidia to restart Chinese sales of its H20 chip would help the US compete better abroad — particularly with Chinese chipmaker Huawei Technologies.

Meanwhile, Commerce Secretary Howard Lutnick told CNBC on Tuesday the renewed sale of H20 chips in China was linked to a trade agreement between the two countries on rare earth magnets — and said the administration was also reversing course from April’s restrictions because the US still does not sell China ‘our best stuff’.

Still, calls for restrictions on advanced chip exports to China have persisted among US lawmakers on both sides of the aisle.

Last week, Senators Elizabeth Warren and Jim Banks wrote to Huang, noting the hardware powering advanced AI ‘is of immense strategic importance’ — and warned such technology could be used to accelerate Beijing’s effort to modernise its military if exported freely. US lawmakers have also proposed tracking chips subject to export controls to ensure they do not end up in the wrong hands.

Beyond export controls, California-based Nvidia — like other tech giants — has been caught in the crosshairs of Trump’s tariff wars abroad, particularly amid tit-for-tat levies with China. But Beijing and Washington recently agreed to pull back some non-tariff restrictions. China says it is approving permits for rare earth magnets to be exported to the US, while Washington has lifted curbs on chip-design software and jet engines.

Nvidia and its CEO have also garnered Trump’s favour in recent months. In April, the company announced it would produce its AI chips in the US for the first time, starting with more than one million square feet of manufacturing space to build and test its specialised Blackwell chips in Arizona and AI supercomputers in Texas.

Trump was quick to applaud Nvidia’s move. He introduced Huang as a ‘smart cookie’ who was helping bring jobs to the US at an ‘Investing in America’ event held at the White House later that month.

Similar to Nvidia, AMD is now poised to restart Chinese sales of its MI308 chips. The California-based company said in a statement that the Commerce Department was moving forward with licence applications for these exports to China, and it plans to resume shipments as those licences are approved.

By RSS/AP