KATHMANDU: Nepal‑India Chamber of Commerce and Industry (NICCI) has informed Finance Minister Rameshore Prasad Khanal that recent changes to India’s goods and services tax (GST) could damage Nepal’s manufacturing sector and widen illegal cross‑border trade.

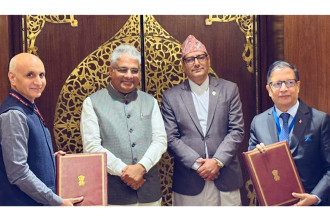

In a meeting with the Finance Minister at his office in Singhadurbar, Kathmandu, on Wednesday, led by NICCI’s Officiating President Kunal Kayal, the chamber briefed the minister on the potential fallout from India’s 56th GST Council decisions, which came into effect on September 22. NICCI said revisions to India’s maximum retail prices (MRPs) on several fast‑moving consumer goods (FMCG) lines will create a price arbitrage that could encourage grey‑channel imports into Nepal and undermine local producers.

A letter submitted to the Ministry of Finance (MoF) said that lower MRPs in India, combined with improved exporter liquidity, will increase incentives for retail‑pack leakage across the open border, particularly in towns adjacent to crossing points. NICCI said this would erode demand for domestically manufactured products, with categories such as soaps, toothpaste, shampoo and food items most at risk, and could place serious pressure on turnover and margins for Nepali manufacturers.

NICCI urged the government to act to protect local industry and jobs, proposing a three‑pronged response: make raw‑material imports cheaper or offer production‑linked incentives so local firms can pass on savings to consumers; raise customs on finished goods to improve the competitiveness of domestic manufacturing; and step up enforcement against parallel imports through routine and random raids, supported by industry intelligence and seizure of MRP‑labelled goods lacking VAT invoices.

The NICCI also raised other concerns during the courtesy call, including the halted initial public offerings under the Securities Board of Nepal (SEBON) and long‑standing foreign direct investment (FDI) issues.

On the occasion, Finance Minister Khanal said the government’s immediate priorities are holding free and fair elections and supporting reconstruction, and acknowledged that some NICCI concerns would require legislative change beyond the current administration’s mandate. He pledged to facilitate the matters where possible, said SEBON would address the IPO suspension soon, and that the GST impact will be examined.

The NICCI delegation included representatives from Nepali and Indian firms such as Berger Nepal, Unilever Nepal, National Insurance Company, Goldstar Shoes and hydropower projects, together with NICCI Treasurer Kiran Malla, executive members Navneet Gupta and Uttam Bhlon, Co‑chair IBF Saibal Ghosh, Director General Keshab Man Singh and other senior officials.

READ ALSO: