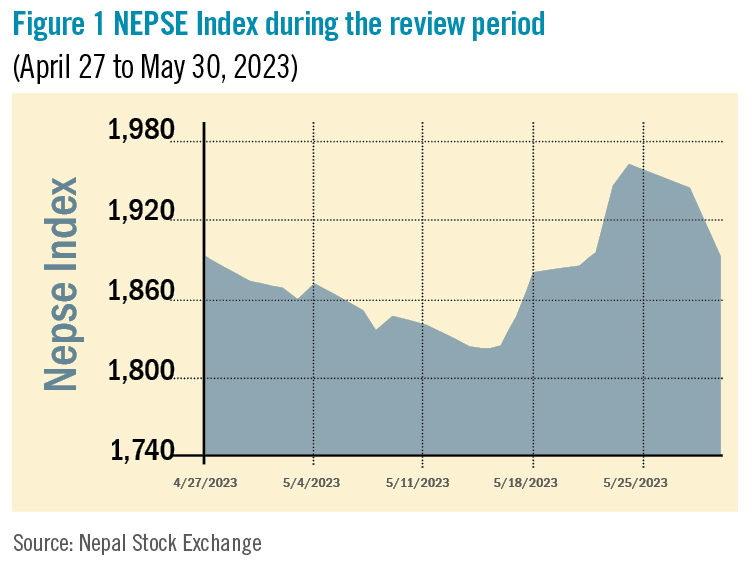

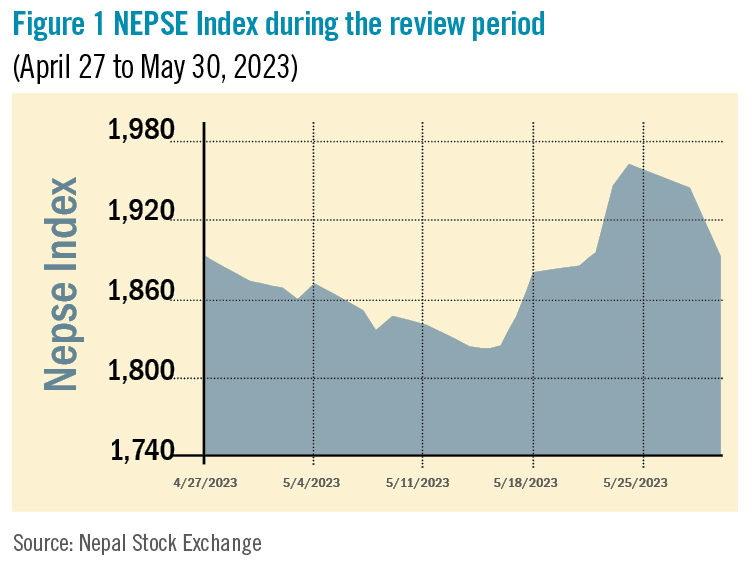

During the review period from April 27 to May 30, the Nepal Stock Exchange (NEPSE) index decreased by 4.33 points (-0.23%) to close at 1,888.61 points. The secondary market continued its downward momentum in this period and reached its lowest point on May 15 at 1,818.31 points. Although the third quarter Monetary Policy review provided some respite to investors, the provisions announced in the fiscal policy for next fiscal year 2080/81 has failed to increase optimism and confidence among investors. During the review period, the overall total market volume increased slightly by 4.45% to Rs 23.52 billion.

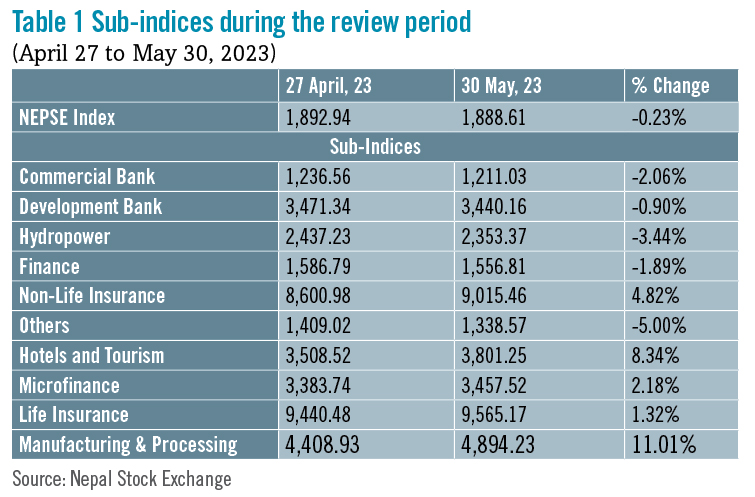

During the review period, five sub-indices landed in the green zone, and the other five fell in the red zone, indicating a volatile trading period.

In the red zone, the Others sub-index (-5%) was the biggest loser with a decline in share prices of Nepal Reinsurance Company (-Rs 42.8) and Nepal Telecom (-Rs 36.1). Hydropower sub-index (-3.44%) followed with fall in share prices of Sayapatri Hydropower (-Rs 47.3), Samling Power (-Rs 47) and Eastern Hydropower (-Rs 45.7).

Commercial Banks sub-index (-2.06%) followed suit with a decrease in the share prices of Nabil Bank (-Rs 16.7), NMB Bank (-Rs 11) and Laxmi Bank (-Rs 9.5). Finance sub-index (-1.89%) also fell as share value of Reliance Finance (-Rs 18.2), Multipurpose Finance (-Rs 16.9) and Best Finance (-Rs 14) decreased. Development Banks sub-index (-0.90%) went down marginally as share prices of Garima Bikas (-Rs 13.5), Green Development (-Rs 13) and Sindhu Development (-Rs 7.6) decreased.

The remaining sub-indices were in the green zone. The Life Insurance sub-index (+1.32%) witnessed an increase in the share price of Suryajyoti Life Insurance (+Rs 18.9), Life Insurance Co Nepal (+Rs 15) and Prabhu Life Insurance (+Rs 2.1). Likewise, Microfinance sub-index (+2.18%) was also in the green as share value of Summit Microfinance (+Rs 95), Support Microfinance (+Rs 90) and Chhimek Microfinance (+Rs 67.1) went up.

Non-life insurance sub-index (+4.82%) followed suit with increase in the share prices of Rastriya Beema (+Rs 1,519), Nepal Insurance (+Rs 43) and Siddhartha Premier Insurance (+Rs 32.9). Hotels and Tourism sub-index (+8.34%) also witnessed a rise in the share prices of Taragaon Regency Hotel (+Rs 75.4), Oriental Hotels (+Rs 60) and Soaltee Hotel (+Rs 37.2). Manufacturing & Processing sub-index (+11.01%) was the biggest winner with increase in the share value of Unilever Nepal (+Rs 9,867), Bottlers Nepal (+Rs 985) and Shivam Cement (+Rs 46.8).

News and Highlights

In the upcoming year fiscal policy, the government has announced plans to issue remittance bonds to Nepalis with labour permit for foreign employment. The policy also aims to promote the participation of Non-Resident Nepalis in the capital market, allowing them to invest in listed hydropower and real sector companies. Additionally, the policy includes provisions for the development of infrastructure to facilitate the operation of the Commodities Exchange Market and Small and Medium Enterprise (SME) platform.

On the public issues front, SEBON has approved the initial public offering (IPO) of Upper Syange Hydropower worth Rs 220 million and Kutheli Bukhari Small Hydropower worth Rs 121.87 million. Siddhartha Capital and NMB Capital were appointed as respective issue managers.

SEBON also approves the further public offering (FPO) of Unique Nepal Microfinance worth Rs 37.94 million with Muktinath Capital asits issue manager.

SEBON approved the mutual fund schemes of Prabhu Smart Fund worth Rs 200 million, NMB Saral Bachat Fund-E worth Rs one billion, and Laxmi Value Fund-II worth Rs 800 million. The issue managers are Prabhu Capital, NMB Capital and Laxmi Capital, respectively.

News and Highlights

In the upcoming year fiscal policy, the government has announced plans to issue remittance bonds to Nepalis with labour permit for foreign employment. The policy also aims to promote the participation of Non-Resident Nepalis in the capital market, allowing them to invest in listed hydropower and real sector companies. Additionally, the policy includes provisions for the development of infrastructure to facilitate the operation of the Commodities Exchange Market and Small and Medium Enterprise (SME) platform.

On the public issues front, SEBON has approved the initial public offering (IPO) of Upper Syange Hydropower worth Rs 220 million and Kutheli Bukhari Small Hydropower worth Rs 121.87 million. Siddhartha Capital and NMB Capital were appointed as respective issue managers.

SEBON also approves the further public offering (FPO) of Unique Nepal Microfinance worth Rs 37.94 million with Muktinath Capital asits issue manager.

SEBON approved the mutual fund schemes of Prabhu Smart Fund worth Rs 200 million, NMB Saral Bachat Fund-E worth Rs one billion, and Laxmi Value Fund-II worth Rs 800 million. The issue managers are Prabhu Capital, NMB Capital and Laxmi Capital, respectively.

News and Highlights

In the upcoming year fiscal policy, the government has announced plans to issue remittance bonds to Nepalis with labour permit for foreign employment. The policy also aims to promote the participation of Non-Resident Nepalis in the capital market, allowing them to invest in listed hydropower and real sector companies. Additionally, the policy includes provisions for the development of infrastructure to facilitate the operation of the Commodities Exchange Market and Small and Medium Enterprise (SME) platform.

On the public issues front, SEBON has approved the initial public offering (IPO) of Upper Syange Hydropower worth Rs 220 million and Kutheli Bukhari Small Hydropower worth Rs 121.87 million. Siddhartha Capital and NMB Capital were appointed as respective issue managers.

SEBON also approves the further public offering (FPO) of Unique Nepal Microfinance worth Rs 37.94 million with Muktinath Capital asits issue manager.

SEBON approved the mutual fund schemes of Prabhu Smart Fund worth Rs 200 million, NMB Saral Bachat Fund-E worth Rs one billion, and Laxmi Value Fund-II worth Rs 800 million. The issue managers are Prabhu Capital, NMB Capital and Laxmi Capital, respectively.

News and Highlights

In the upcoming year fiscal policy, the government has announced plans to issue remittance bonds to Nepalis with labour permit for foreign employment. The policy also aims to promote the participation of Non-Resident Nepalis in the capital market, allowing them to invest in listed hydropower and real sector companies. Additionally, the policy includes provisions for the development of infrastructure to facilitate the operation of the Commodities Exchange Market and Small and Medium Enterprise (SME) platform.

On the public issues front, SEBON has approved the initial public offering (IPO) of Upper Syange Hydropower worth Rs 220 million and Kutheli Bukhari Small Hydropower worth Rs 121.87 million. Siddhartha Capital and NMB Capital were appointed as respective issue managers.

SEBON also approves the further public offering (FPO) of Unique Nepal Microfinance worth Rs 37.94 million with Muktinath Capital asits issue manager.

SEBON approved the mutual fund schemes of Prabhu Smart Fund worth Rs 200 million, NMB Saral Bachat Fund-E worth Rs one billion, and Laxmi Value Fund-II worth Rs 800 million. The issue managers are Prabhu Capital, NMB Capital and Laxmi Capital, respectively.

Outlook

The secondary market had shown signs of recovery crossing the 1,900-point as interest rates were decreasing, along with strong inflow of remittances and positive anticipation about the upcoming fiscal policy. Nonetheless, multiple stringent measures affecting the capital market declared in the fiscal policy has deteriorated investor sentiment. The market is likely to continue in the current momentum. This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO:

Published Date: June 27, 2023, 12:00 am

Post Comment

E-Magazine

RELATED Beed Take