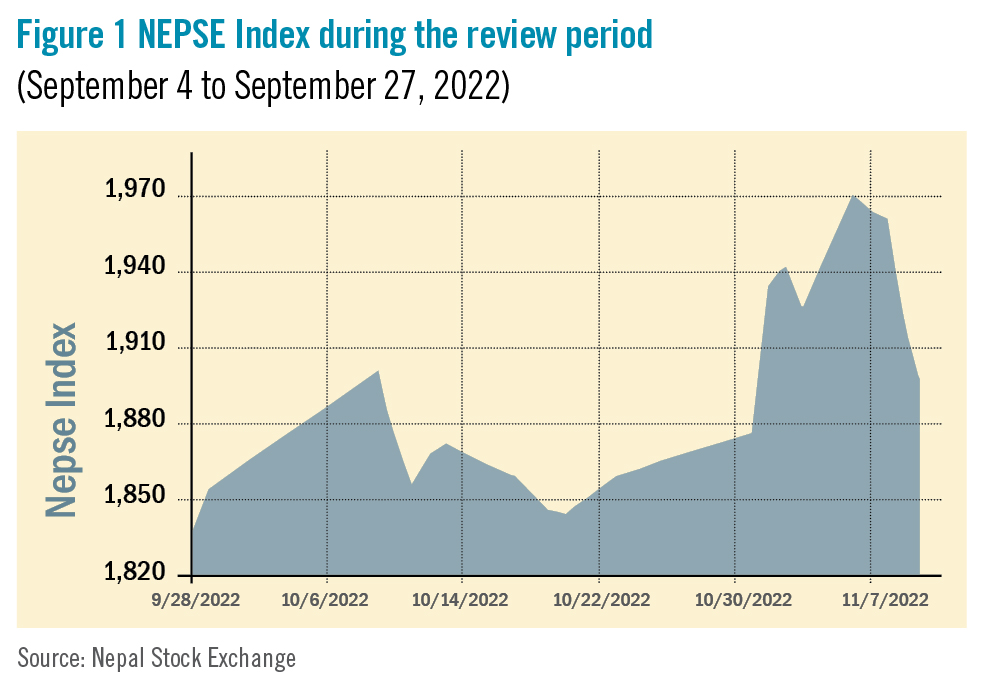

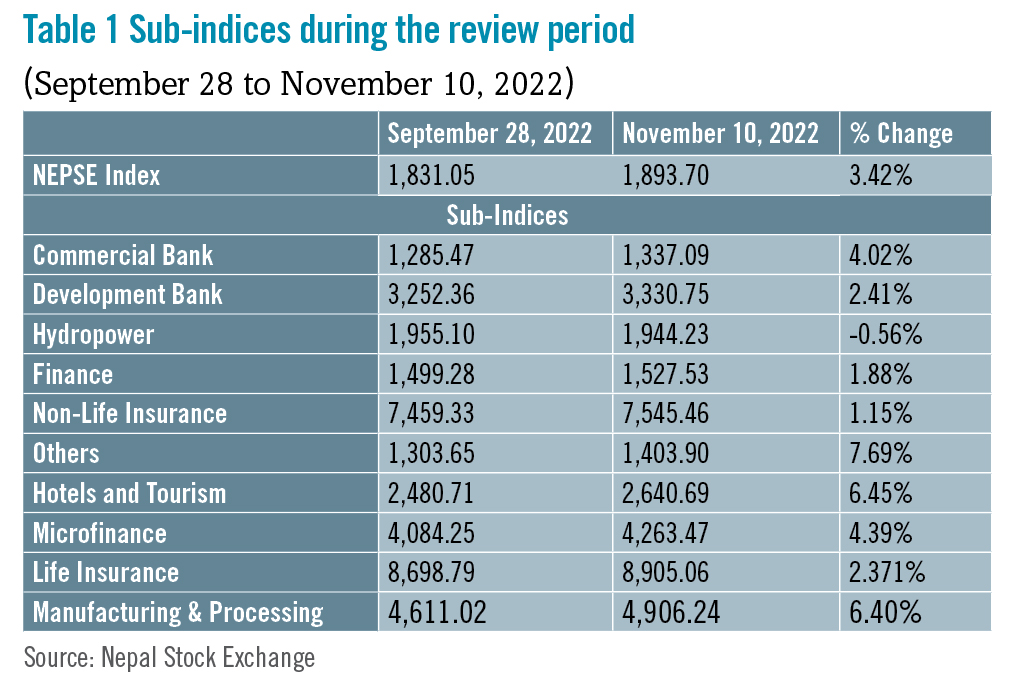

During the review period of September 28 to November 10, the Nepal Stock Exchange (NEPSE) index increased by a notable 62.65 points (+3.42%) to close at 1,893.70 points. In contrast to prior trading times, the market provided investors with some relief. Increased selling pressure during the Dashain and Tihar holidays in September and October had further skewed a market that had already been depressed by rising market interest rates. However, as the holidays drew to an end on October 30, traders in the secondary market were back with some confidence in anticipation of the upcoming November 20 federal elections. Further, key listed companies have also started to announce dividends from their earnings from the last fiscal year 2021/22. On November 6, the market reached a high of 1,965.36 points, although such gains have not been steady. The total market volume during the review period increased marginally by 8.92% with total transaction of Rs 19.58 billion. During the review period, contrary to the previous period, nine of the sub-indices landed in the green zone and only one landed in the red zone, indicating slight recovery across the sub-sectors. Others sub-index (+7.69%) was the biggest gainer as the share value of Citizen Investment Trust (+Rs 43.1) and Nepal Telecom (+Rs 35) increased substantially. Hotels and tourism sub-index (+6.45%) was second in line as it witnessed a rise in the share prices of Oriental Hotels (+Rs 52), Taragaon Regency (+Rs 20.5) and Soaltee Hotel (+Rs 10). Manufacturing and Processing sub-index (+6.40%) followed suit with an increase in the share prices of Unilever Nepal (+Rs 2,080), Himalayan Distillery (+Rs 268), and Shivam Cements (+Rs 27.6). Likewise, Microfinance sub-index (+4.39%) also rose as share value of Chhimek Microfinance (+Rs 110), Nirdhan Utthan Microfinance (+Rs 53) and Deprosc Microfinance (+Rs 45) went up. Similarly, Commercial bank sub-index (+4.02%) went up as share prices of NIC Asia Bank (+Rs 51.1), Nabil Bank (+Rs 45), and Everest Bank (+Rs 41.9) increased. Development bank sub-index (+2.41%) also surged with a rise in the share value of Shine Resunga Development (+Rs 25.3), Garima Development (+Rs 18.9), and Miteri Development (+Rs 18). Along the same lines, Life insurance sub-index (+2.37%) witnessed a rise in the share prices of National Life Insurance (+Rs 29), Asian Life Insurance (+Rs 22.1), and Nepal Life Insurance (+Rs 2). Finance sub-index (+1.88%) faced an upswing with a rise in the share value of Manjushree Finance (+Rs 45.6), Gurkhas Finance (+Rs 21) and Central Finance (+Rs 11.9). Non-life insurance sub-index (+1.15%) also followed suit with escalation in the share value of Rastriya Beema Company (+Rs 309.9), Shikhar Insurance (+Rs 16) and Prudential Insurance (+Rs 13). Lastly, Hydropower sub-index (-0.56%) was the only sub-index which lost value with a marginal decline in share prices of Himalayan Power (-Rs 41.9), Arun Kabeli (-Rs 20.7) and Arun Valley Hydropower (-Rs 15.5).

News and Highlights

The financial market of Nepal has witnessed mergers of many listed companies, especially banks and financial institutions in the recent period. However, such merger-opting companies have had to go through a muted response from the Securities Exchange Board of Nepal (SEBON) about their trading in the secondary market. In this review period, SEBON has ended the indefinite merger suspension period for merger opting companies. In other words, it has implemented ‘Guidelines on Merger/Acquisition of Public Companies 2079’ which has paved the way to open trading of merger-opting companies. On the public issues front, Securities Exchange Board of Nepal (SEBON) has approved the initial public offering (IPO) of Barahi Hydropower worth Rs 250 million. NIBL Ace Capital has been hired as its issue manager. Similarly, SEBON has added the IPOs of four other hydropower companies to its pipeline which includes Menchhiyam Hydropower worth Rs 1.627 million, Upper Lohare Hydropower worth Rs 2.498 billion, Mai Khola Hydropower worth Rs 192.15 million, and Chirkhwa Hydropower (+Rs 120 million). NIC Asia Capital is the issue manager for Menchhiyam Hydropower and Upper Lohare Hydropower, while Prabhu Capital and RBB Merchant Banking are the issue managers for Mai Khola Hydropower and Chirkhwa Hydropower.

Outlook

Investor confidence has been deteriorating during the past few review periods as a result of the increased market selling pressure brought on by rising long-term interest rates and a liquidity shortage. Additionally, due to the holidays in September through October, the secondary market only operated for a few days with increased selling pressure. However, given the impending federal election, higher market expenditure and consumption related to the election, there is likelihood of an increase in economic activities, the distribution of shareholder dividends, and other factors which will result in investor confidence. This is an analysis from beed Management. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis. READ ALSO: