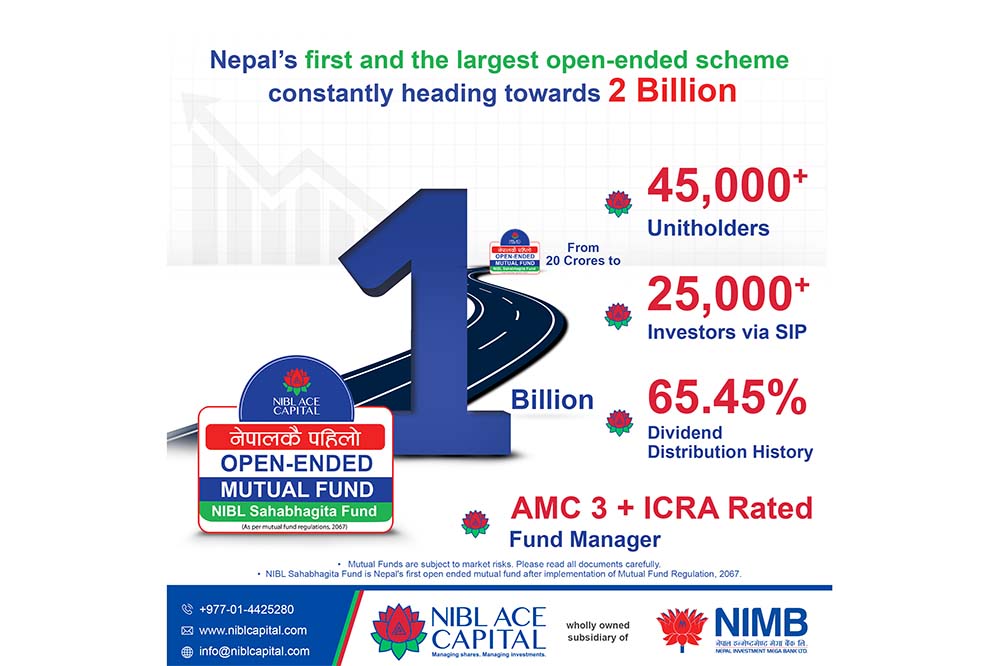

KATHMANDU: Nepal's first open-ended scheme 'NIBL Sahabhagita Fund' has attained a milestone size of 1 billion. The scheme operated under NIBL Mutual Fund was launched in 2019 with a total size of Rs 200 million.

Nepal Investment Mega Bank Ltd (NIMBL), with 36th years of successful operations and one of the leading banks of Nepal, had registered 'NIBL Mutual Fund' as a Fund Sponsor in the Securities Board of Nepal (SEBON) with an objective to diverse Mutual Fund Schemes in Nepali Capital Market.

Considering the high demand of investors, NIBL Ace Capital approached SEBON to increase the size of the scheme to Rs 2 billion and gained approval from SEBON on January 1, 2023.

Also, considering the developing capital market of Nepal, the growing mutual fund industry and increasing investors in mutual funds and being Nepal's first open-ended scheme, this scheme has been successful in giving reasonable returns to its unit holders since the first year of its operation, under which a total of 65.45% dividend have been distributed in three years of successful operations and an average annual return of 21.81%. So far the scheme has yielded the highest returns compared to other open-ended mutual fund schemes.

Investors who want to invest in this scheme can invest by submitting duly filled forms available at all the branch offices of NIMB and NIBL Ace Capital and distribution agents. Investors can also apply online by visiting the website of NIBL Ace Capital. One can participate in a Dividend Re-Investment Plan as well which eliminates constant logistical hassles and ensures investors don’t miss out on an investment opportunity.

With skilled and experienced fund managers, the scheme started with a size of 200 million and was able to gain significant participation of investors due to its lucrative returns, and as of now, it has crossed a size of more than 1 billion becoming the largest ever open-ended scheme in Nepal's capital market.

READ ALSO:

Published Date: January 19, 2023, 12:00 am

Post Comment

E-Magazine