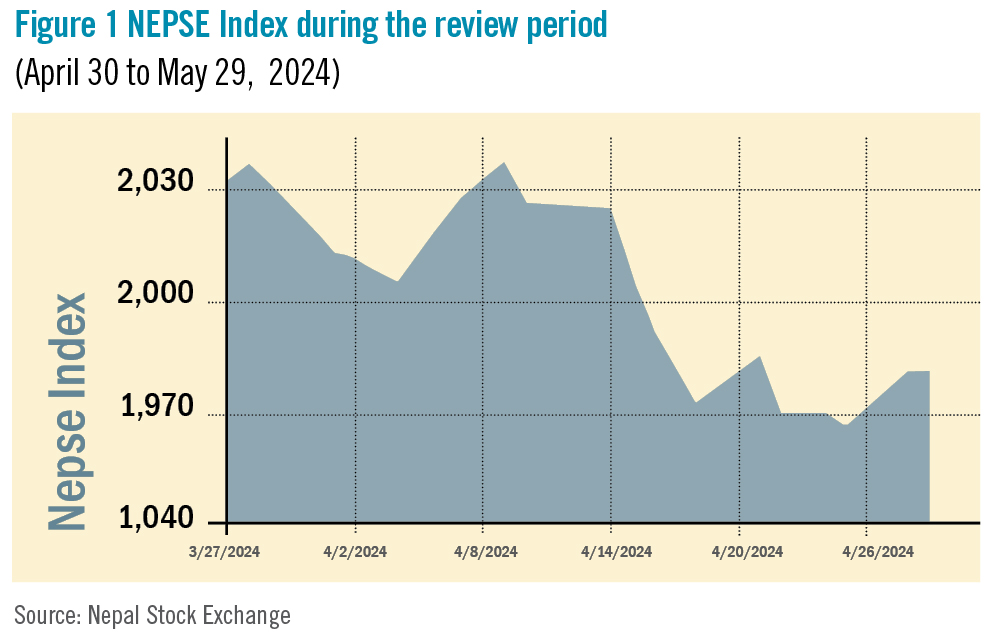

The Nepal Stock Exchange (NEPSE) index rose by 98.32 points (+4.94%) to close at 2,089.42 points in the review period between April 30 to May 29, 2024. The market saw a strong upward momentum, reaching its highest on May 22 at 2,131.49 points. However, it saw a slight dip towards the end of the period. The budget announcement failed to excite investors, which drove up selling activity. The overall market volume during the review period surged by 38% to Rs 76.93 billion.

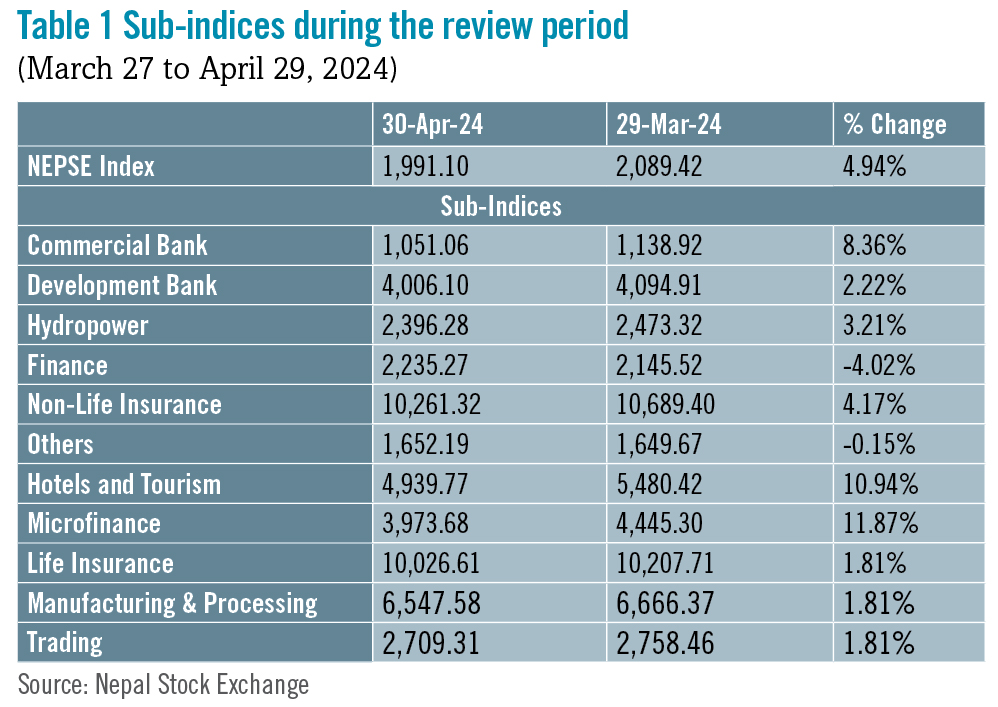

During the review period, nine of the 11 sub-indices landed in the green zone, and the remaining two in the red zone.

In the green zone, Microfinance sub-index (+11.87%) was the biggest winner as the share value of Shrijanshil Microfinance (+Rs 474.3), Himalayan Microfinance (+Rs 471), and Upakar Microfinance (+Rs 398) increased substantially. The Hotels and Tourism sub-index (+10.94%) followed with a surge in share prices of Kalinchowk Darshan (+Rs 472.8), Chandragiri Hills (+Rs 118), and City Hotel (+Rs 91.9). the Commercial Bank sub-index (+8.36%) was third in line as it witnessed a rise in the share prices of NIC Asia (+Rs 62), Nabil Bank (+Rs 60), and Siddhartha Bank (+Rs 36.4).

Next was Non-Life Insurance sub-index with an increase in share prices of Rastriya Beema (+Rs 286), Sagarmatha Lumbini Insurance (+Rs 68), and Siddhartha Premier Insurance (+Rs 55). Likewise, Hydropower sub-index (+3.21%) followed suit as the share prices of Bhagwati Hydropower (+Rs 151.3), Buddha Bhumi Nepal Hydropower (+Rs 141), Super Madi Hydropower (+Rs 98), and Ru Ru Hydropower (+Rs 98) went up. Development Bank sub-index (2.22%) saw positive changes with the increase in share prices of Narayani Development Bank (+Rs 189), Corporate Development Bank (+Rs 35.5), and Miteri Development Bank (+Rs 30.5).

The Manufacturing and Processing sub-index (+1.81%) also grew as the share prices of Unilever Nepal (+Rs 3,786.1), Bottlers Nepal-Terai (+Rs 369.2), and Sarbottam Cement (+Rs 76.2) increased. Similarly, the Trading sub-index (+1.81%) also went up as share prices of Bishal Bazar (+Rs 158) and Salt Trading Corporation (+Rs 65) increased. Life Insurance sub-index (+1.81%) saw a similar rise with an increment in share value of Life Insurance Corporation (+Rs 69.9), Asian Life Insurance (+Rs 28.2), and Citizen Life Insurance (+Rs 22.1).

In the red zone, the Others sub-index (-0.15%) saw a slight decline with the fall in the share prices of Nepal Reinsurance Company (-Rs 37) and Himalayan Reinsurance (-Rs 10.9). Finally, Finance sub-index (-4.02%) was the biggest loser in the review period with a drop in share prices of Gurkhas Finance (-Rs 75.2), Goodwill Finance (-Rs 34.5), and Nepal Finance (-Rs 32.7).

News and Highlights

As per the Economic Survey for Fiscal Year 2023/24, the number of DEMAT accountholders stood at 6.22 million as of mid-March 2024, which is around 21.3% of the total population. Similarly, the number of MeroShare accounts has increased to 5.26 million as of mid-March 2024, which is 18.03% of the total population. It shows increasing participation of Nepali investors in the capital market.

In the third-quarter review of the Monetary Policy for FY 2023/24, Nepal Rastra Bank has permitted banks and financial institutions (BFIs) to sell up to 20% of their primary capital in one financial year; it is a significant jump from the previous limit of 1% of primary capital in a year.

Additionally, the Securities Board of Nepal (SEBON) reduced the commission rates of brokers operating in the secondary market by 10% from May 14 onwards. As per the revised rates, investors will pay commissions between 0.24% and 0.36%, depending on the transaction amount; down from the previous range of 0.27% to 0.40%. Moreover, the budget for the upcoming Fiscal Year 2024/25, announced on May 28, left investors disappointed. Despite investor associations advocating for reduction in capital gains taxes, the budget made no changes to the current rates of 7.5% on short-term capital gains and 5% on long-term capital gains. However, it did announce that a provision would be introduced requiring companies with capital exceeding a certain amount to be listed on the stock market. This aims to ensure transparency in the markets.

SEBON neither granted approval to any initial public offering (IPO) nor added any under preliminary review in the review period. It has currently halted the issuance of IPOs till the appointment of a chairman, which has led to dozens of IPOs being backlogged in its pipeline. Nonetheless, SEBON has included the Nepal SBI Bank Limited Debenture (10 years, 7%) under preliminary review in its debenture pipeline. The issue is worth Rs 3 billion and Nabil Investment Banking has been appointed the issue manager.

Outlook

While the third quarter Monetary Policy review for FY 2023/24 provided some respite to the market, the budget for the upcoming FY 2024/25 was unable to meet investors’ expectations. While the market has slightly dipped following the budget announcement, it maintains an overall positive outlook as indicated by the surging market volume.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warranty is made for the usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.