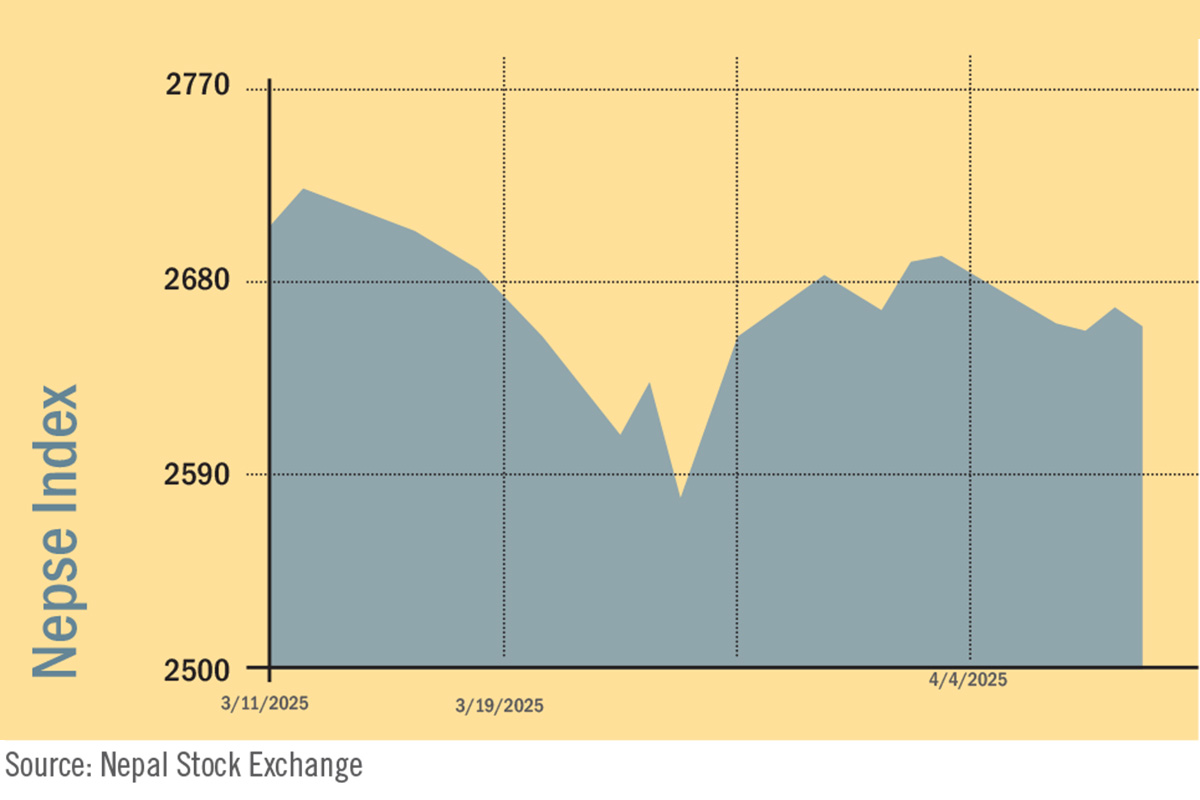

The Nepal Stock Exchange (NEPSE) index fell by 84.63 points (-3.07%) to close at 2,667.68 points during the review period between March 11 and April 10 with the index hitting its lowest point on March 25 at 2,582.73 points. While the period initially saw an upward recovery following this low, the momentum could not be sustained and it closed on the lower side by the end of the review period at 2,667.68 points. The decline was influenced by investor caution surrounding SEBON’s new regulatory directives, including higher capital requirements for brokers and merchant bankers, along with a slowdown in IPO approvals and global market volatility. Trading volume also saw a decline, reflecting weaker investor sentiment during the period. (See Figure 1)

Figure 1: NEPSE Index during the review period

March 11 to April 10, 2025

During the review period, nine of the eleven sub-indices landed in the red zone, while only two sub-indices ended in green, indicating strong selling pressures across sectors.

The Trading sub-index (-12.15%) was the biggest loser as the share value of Salt Trading Corporation (-Rs 209.57) decreased substantially. Hydropower sub-index (-6.41%) was second in line as it witnessed a fall in share prices of Kutheli Bukhari Small Hydropower (-Rs 282.97), Upper Hewakhola Hydropower (-Rs 171.1) and Eastern Hydropower (-Rs 150.86).

Finance sub-index (-6.01%) followed suit with decrease in the share value of Nepal Finance (-Rs 46.25), Goodwill Finance (-Rs 44.93) and ICFC Finance (-Rs 43.38). Similarly, Development Bank sub-index (-5.44%) also fell as share prices of Corporate Development Bank (-Rs 214.83), Saptakoshi Development Bank (-Rs 194.72) and Green Development Bank (-Rs 166.57) went down.

The Microfinance sub-index (-5.24%) witnessed a fall in the share prices of Upakar Laghubitta (-Rs 562.61), Samudayik Laghubitta (-Rs 476.4) and Nesdo Sambriddha Laghubitta (-Rs 453.25). Along the same lines, Non-Life Insurance sub-index (-4.55%) saw a decline in share values of Rastriya Beema (-Rs 230), NICL (-Rs 182.12) and Sanima GIC Insurance (-Rs 92.77). Hotels and Tourism sub-index (-2.71%) followed, with a drop in the share prices of Taragaon Regency (-Rs 56.29), Oriental (-Rs 51.41) and Kalinchowk Darshan (-Rs 48.2). Further, Commercial Bank sub-index (-2.39%) also saw a decline in the share value of Standard Chartered (-Rs 27.91), Prabhu Bank (-Rs 9.13) and Nepal Bank (-Rs 8.88).

Finally, among the sub-indices, the Others (-0.65%) sub-index lost the least with a decline in the share value of Nepal Republic Media (-Rs 35.9), Nepal Warehousing Company (-Rs 32.79) and Muktinath Krishi Company (-Rs 21.79).

In the green zone, Manufacturing and Processing sub-index (+2.11%) witnessed an increase in share prices of Unilever Nepal (+Rs 1,120) and Bottlers Nepal (Terai) (+Rs 43.33). The Life Insurance sub-index (+3.51%) emerged as the top performer with a slight gain in share values of Guardian Micro-Life Insurance (+Rs 601.14). (See Table 1)

News and Highlights

During the review period, Nepal’s capital market saw notable developments led by the Securities Board of Nepal and Nepal Stock Exchange. On March 25, Choodamani Chapagain was appointed as NEPSE’s new CEO replacing Narad Kumar Luitel after concerns over his non-financial background. This leadership change came alongside key regulatory reforms by SEBON aimed at strengthening the market.

Under the amended Securities Businessperson (Merchant Bankers) Regulations 2008, merchant bankers can now underwrite up to the net worth of their parent banks or insurance companies, helping them support larger IPOs and raise more capital.

On March 26, SEBON introduced a Merger/Acquisition Directive for Securities Business Operators 2025 making it easier for 90 brokers and two dealers to merge. Further, after the introduction of the bylaw, the Stockbroker Merger Directive raised the capital requirement for brokers from Rs 20 million to Rs 200 million, encouraging smaller firms to consolidate or recapitalise.

Table 1: Sub-indices during the review period

March 11 to April 10, 2025

|

|

March 11, 2025 |

April 10, 2025 |

% Change |

|

NEPSE Index |

2,752.31 |

2,667.68 |

-3.07% |

|

Sub-Indices |

|||

|

Commercial Bank |

1,392.35 |

1,359.11 |

-2.39% |

|

Development Bank |

5,762.00 |

5,448.40 |

-5.44% |

|

Hydropower |

3,681.66 |

3,445.77 |

-6.41% |

|

Finance |

2,711.23 |

2,548.34 |

-6.01% |

|

Non-Life Insurance |

12,847.68 |

12,263.71 |

-4.55% |

|

Others |

2,450.05 |

2,434.06 |

-0.65% |

|

Hotels and Tourism |

6,644.73 |

6,464.37 |

-2.71% |

|

Microfinance |

5,088.19 |

4,821.53 |

-5.24% |

|

Life Insurance |

13,282.93 |

13,748.94 |

3.51% |

|

Manufacturing & Processing |

7,122.57 |

7,273.11 |

2.11% |

|

Trading |

4,660.76 |

4,094.54 |

-12.15% |

|

Source: Nepal Stock Exchange |

|||

However, IPO approvals have slowed, with only five out of 84 proposals approved since November 2024. The delays are attributed to ongoing investigations and concerns over share pricing, which have affected companies fundraising efforts and limited investor opportunities. Despite the slowdown, two IPOs were approved during the review period: Sanvi Energy, which offered 43% of its shares to the public with Nepal SBI Merchant Banking Limited as issue manager, and Trade Tower under the ‘Others’ category, managed by Laxmi Sunrise Capital.

Outlook

Looking ahead, Nepal’s capital market is expected to focus on the impacts of recent regulatory reforms. With stricter capital requirements and new merger directives, many lesser-capitalised stock brokers may be forced to consolidate, reshaping the market structure. While these reforms aim to strengthen long-term stability and service quality, they may also create short-term disruptions.

The investor sentiment remains cautious due to IPO delays and narrowed fundraising opportunities. However, with new leadership at NEPSE and growing collaboration with SEBON, there is some optimism for smoother reforms and renewed momentum. The market’s near-term outlook will largely depend on how effectively SEBON clears the IPO backlog and instils confidence among investors. Despite possible turbulence, the reforms lay the groundwork for a more resilient and transparent capital market in the long run.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warranty is made for the usefulness or completeness of this information and no liability will be accepted for the consequences of actions taken based on this analysis.