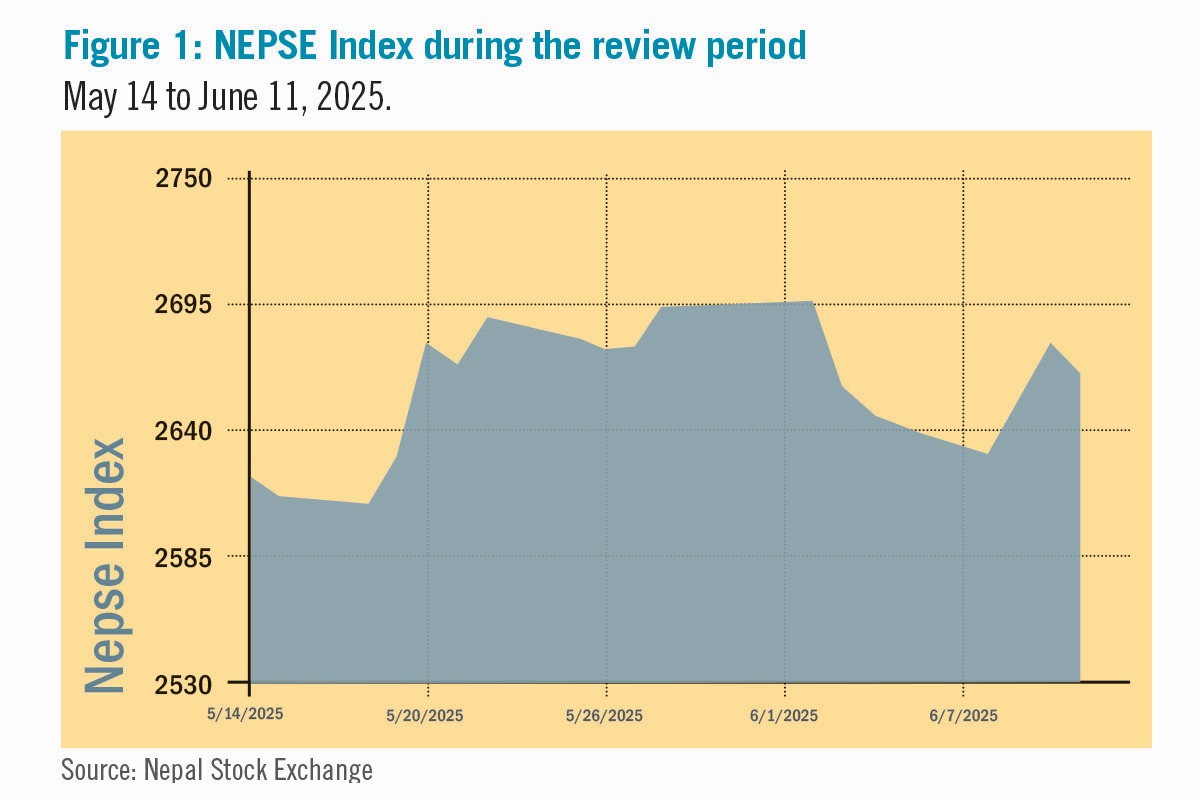

The Nepal Stock Exchange (NEPSE) index rose by 29.26 points (+1.11%) to close at 2,664.47 points between May 14 and June 11. Throughout this period, the index fluctuated sharply, reaching its highest point of 2,694.66 on June 2 and dipping to a low of 2,609.05 on May 18. Compared to the previous review period, which saw a 54% surge in the total volume of shares traded, this period marked a shift in market sentiment with trading volume experiencing a temporary decline of up to 12%. These fluctuations reflect a market environment characterised by both optimism and caution, highlighting the dynamic and active trading behaviour among investors. See Figure 1.

During the review period, four of the 11 sub-indices ended in the red zone, while the remaining seven posted gains. The Hydropower, Banking and Others sub-indices led the gains, while Life and Non-Life Insurance and Trading sectors dragged overall performance.

The Others sub-index (+4.82%) was the biggest gainer as the share value of Nepal Reinsurance (+Rs 114.11), Pure Energy (+Rs 7) and Muktinath Krishi (+Rs 13.69) increased substantially. The Banking sub-index (+3.62%) was second witnessing rise in share prices of Everest (+Rs 29.56), Siddhartha (+Rs 28.41) and Global IME (+Rs 27.89).

The Hydropower sub-index (+2.57%) followed suit with increase in the share values of Butwal Power (+Rs 255.66), River Falls (+Rs 151.33) and Super Madi (+Rs 110.07). The Microfinance sub-index (+0.83%) saw an incline with Aatmanirbhar Laghubitta (+Rs 306.15), Upakar Laghubitta (+Rs 168.23) and Swabhiman Laghubitta (+Rs 67.98) going up. Likewise, the Development Bank sub-index (+0.77%) witnessed a rise in the share prices of Saptakoshi (+Rs 230.17), Corporate (+Rs 169.51) and Narayani (+Rs 94.78).

Along the same lines, the Finance sub-index (+0.76%) had positive movements in Shree Investment and Finance (+Rs 70.15), Guheshwori Merchant Bank and Finance (+Rs 13.79) and Best Finance (+Rs 6.76). Hotels and Tourism sub-index (+0.25%) saw an incline with a rise in the share prices of Chandragiri Hills (+Rs 57.27), Shivam Holdings (+Rs 18.57) and Oriental Hotels (+Rs 2.47).

On the downside, Manufacturing and Processing sub-index (-1.55%) declined following a drop in the share prices of Bottlers Nepal Terai (-Rs 52), Himalayan Distillery (-Rs 31.1) and Sarbottam Cement (-Rs 30). The Non-Life Insurance sub-index (-2.72%) followed with Nepal Micro Insurance (-Rs 528.65), Rastriya Beema (-Rs 150.8) and Prabhu Insurance (-Rs 49.76) share values going down.

The Trading sub-index (-3.58%) witnessed a decline in the share prices of Salt Trading (-Rs 238.68) and Bishal Bazar (-Rs 200.64). And, the Life Insurance sub-index (-4.23%) was the worst performer with decrease in the share value of Crest Micro Life (-Rs 647.1), Guardian Micro-Life (-Rs 233.99) and Asian Life (-Rs 229.27). See Table 1.

Table 1: Sub-indices during the review period

|

|

May 14, 2025 |

June 11, 2025 |

% Change |

|

NEPSE Index |

2,635.21 |

2,664.47 |

1.11% |

|

Sub-Indices |

|||

|

Commercial Bank |

1,314.07 |

1,361.64 |

3.62% |

|

Development Bank |

5,427.46 |

5,469.12 |

0.77% |

|

Hydropower |

3,541.83 |

3,632.90 |

2.57% |

|

Finance |

2,414.64 |

2,433.10 |

0.76% |

|

Non-Life Insurance |

12,551.32 |

12,209.82 |

-2.72% |

|

Others |

2,227.60 |

2,335.04 |

4.82% |

|

Hotels and Tourism |

6,725.93 |

6,742.48 |

0.25% |

|

Microfinance |

4,664.98 |

4,703.71 |

0.83% |

|

Life Insurance |

13,482.69 |

12,912.97 |

-4.23% |

|

Manufacturing & Processing |

7,225.78 |

7,114.09 |

-1.55% |

|

Trading |

4,388.97 |

4,232.01 |

-3.58% |

Source: Nepal Stock Exchange

News and Highlights

This review period has seen decisive forward momentum in Nepal’s capital markets marked by significant policy announcements and reform commitments. On June 10, the Securities Board of Nepal (SEBON) announced plans to prohibit hydropower companies from issuing IPOs before beginning electricity generation. This policy, suggested by the High-Level Economic Reform Commission, aims to protect investors from premature public offerings.

Just two days prior, on June 8, on SEBON’s 33rd anniversary, the Finance Minister emphasised the need for SEBON to resist external pressures, curb insider trading and market manipulation, and introduce new financial instruments to modernise the market. In line with this, the government’s budget for FY 2025/26 includes key structural reforms for NEPSE and an initiative to allow Non-Resident Nepalis to participate in secondary market trading, aimed at boosting competitiveness and investor inclusivity.

On June 12, a government-commissioned high-level study recommended the establishment of a second stock exchange to enable competition and end NEPSE’s monopoly. The study has proposed board restructuring, enhanced technology standards, and public listing requirements in new exchanges. Additionally, SEBON’s comprehensive reform package, backed by the same commission, outlines a one-year restructuring plan for SEBON, NEPSE and CDS & Clearing. This intends to replace private sector and Ministry of Law representation with financial and central bank experts, introducing margin loans, bond market enhancements, and streamlined issuance processes.

Despite the governance challenges, SEBON approved two initial public offerings (IPOs) for the hydropower sector during the review period. Him Star Urja Company plans to raise Rs 111.9 million with NIC Asia Capital as the issue manager, while Daramkhola Hydro Energy is planning to raise Rs 395 million with Laxmi Sunrise Capital as the issue manager.

Outlook

The ongoing allegations and governance challenges at SEBON combined with the planned restructuring and regulatory uncertainties may impact investor confidence and market stability in the short term. Delays in IPO approvals and licensing of new market infrastructure could slow capital market growth. However, the government’s restructuring efforts and the demand for a revised securities bill present opportunities for improving regulatory oversight and market transparency. The successful implementation of these reforms will be essential to restoring trust among market participants and fostering a more dynamic and resilient capital market environment in Nepal.

This is an analysis from beed Management. No expressed or implied warranty is made for the usefulness or completeness of this information, and no liability will be accepted for the consequences of actions taken based on this analysis.