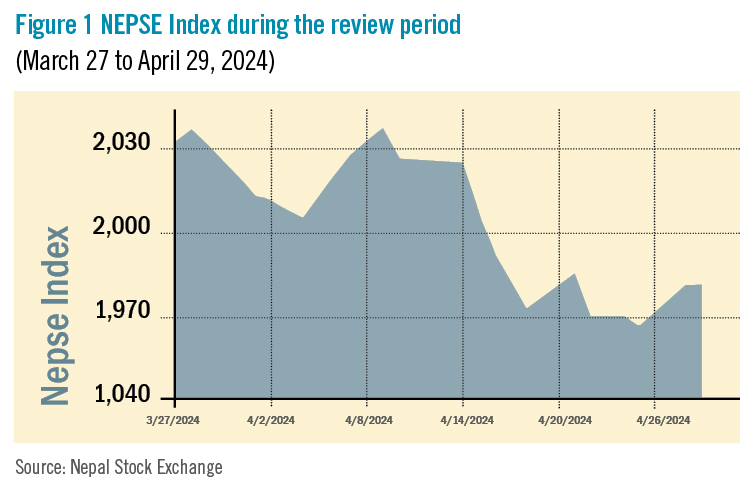

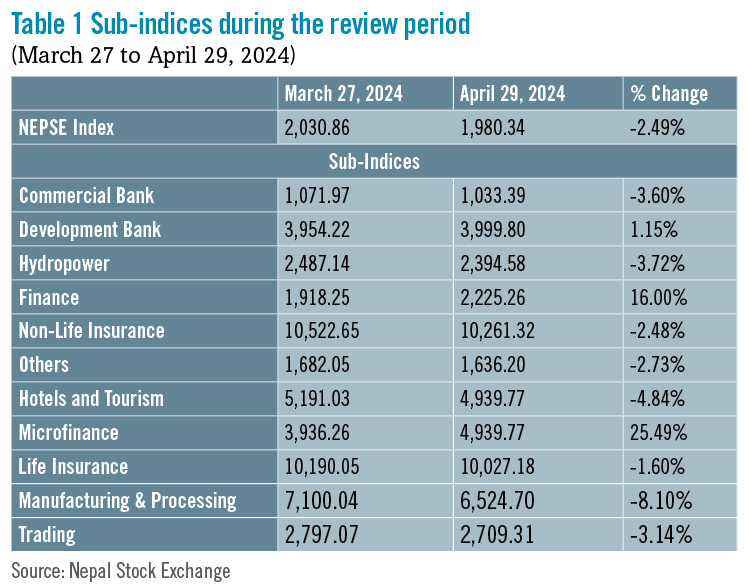

The Nepal Stock Exchange (NEPSE) index fell by 50.52 points (-2.49%) to close at 1,980.34 points in the review period between March 27 to April 29, 2024. The market failed to sustain the positive momentum gained during the previous period, and reached its lowest point on April 25 at 1,965.93 points. Investor confidence was dampened by discouraging third quarter performance of the listed companies particularly of financial institutions. The overall market volume during the review period dropped by 12% to Rs 55.64 billion

During the review period, eight of the 11 sub-indices landed in the red zone. Manufacturing and Processing sub- index (-8.10%) was the biggest loser as the share value of Bottlers Nepal-Balaju (-Rs 2,376), Bottlers Nepal-Terai (-Rs 1,056) and Sarbottam Cement (-Rs 114.1) decreased substantially. The Hotels and Tourism sub-index (-4.48%) followed suit with a drop in the share prices of Taragaon Regency Hotel (-Rs 97.8), Oriental Hotels (-Rs 60.1) and Chandragiri Hills (-Rs 51).

Hydropower sub-index (-3.72%) was the next in line as it witnessed a decline in the share prices of Ru Ru Hydropower (-Rs 178), Chirkhawa Hydropower (-Rs 108) and Molung Hydropower (-Rs 71). Commercial Bank sub-index (-3.60%) followed suit with a drop in the share prices of NIC Asia (-Rs 61), Nepal Bank (-Rs 20.6) and Himalayan Bank (-Rs 14.9). Likewise, Trading sub-index (-3.14%) also fell as share value of Salt Trading Corporation (-Rs 225) and Bishal Bazar (-Rs 112) went down.

The Others sub-index (-2.73%) also declined as the share prices of Muktinath Krishi (-Rs 94.8), Sonapur Minerals and Oil (-Rs 41.9) and Nepal Reinsurance (-Rs 32.6) decreased. Similarly, the Non-life Insurance sub-index (-2.48%) went down as share prices of Rastriya Beema (-Rs 950), Sagarmatha Lumbini Insurance (-Rs 42.8) and Neco Insurance (-Rs 27) declined. Life Insurance sub-index (-1.60%) saw a dip with a decline in share values of Suryajyoti Life Insurance (-Rs 86.4), Life Insurance Corporation Nepal (-Rs 35) and Prabhu Mahalaxmi Life Insurance (-Rs 24).

In the green zone, the Development Bank sub-index (+1.15%) saw a slight increment with a rise in the share prices of Green Development Bank (+Rs 53.5), Miteri Development Bank (+Rs 30.5) and Sindhu Bikash Bank (+Rs 28). The Finance sub-index (+16.00%) was next in line as share value of Pokhara Finance (+Rs 327), Nepal Finance (+Rs 148) and Janaki Finance (+Rs 129) climbed up. Finally, Microfinance sub-index (+25.49%) was the biggest gainer in the review period with a surge in shares prices of Gurans Microfinance (+Rs 802), Manushi Microfinance (+Rs 309) and Unnati Sahakarya (+Rs 218).

News and Highlights

The Securities Board of Nepal (SEBON) neither granted approval for initial public offering (IPO) nor added any under preliminary review in the review period. SEBON has halted the issuance of IPOs till the appointment of a chairman, which has led to dozens of IPOs being backlogged in its pipeline. The process for appointing the chairman has been temporarily suspended after the finance minister expressed dissatisfaction regarding the composition of the shortlisted candidates. Nonetheless, SEBON has included Himalayan Dirghakalin Bachat Yojana (open-ended fund) by Himalayan Mutual Fund under its mutual fund pipeline. The issue is worth Rs 1 billion and Himalayan Capital has been appointed to serve as its fund manager.

Outlook

The Nepal Investment Summit 2024, which concluded recently, effectively conveyed a favourable message to investors. A multitude of favourable policy reforms, the implementation of a streamlined investment procedure, and fresh investment commitments are anticipated to instill greater assurance among private sector stakeholders, including secondary market investors.

This is an analysis from beed Management Pvt. Ltd. No expressed or implied warranty is made for the usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.