KATHMANDU: Chamber of Industries Morang (CIM) has welcomed the monetary policy for fiscal year 2025/26 announced by Nepal Rastra Bank (NRB).

The organisation stated that the policy was released at an appropriate time and aligns with the government’s budget for the upcoming fiscal year.

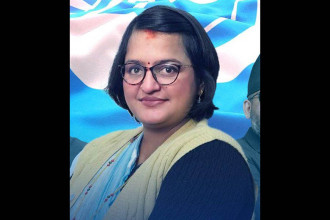

CIM President Nand Kishor Rathi said the revised rules concerning real estate and share loans would help revitalise the market during the ongoing economic slowdown. He added that the changes are likely to contribute to a more dynamic economy.

In a statement issued by CIM, Rathi said the policy includes increasing loan limits for house construction and purchase, permitting restructuring and rescheduling of loans for land development and building construction firms, and raising the single-client loan limit for margin-type loans backed by shares. He claimed these measures would address the sustained sluggishness in the sector.

The policy also reduces the bank rate, deposit collection rate and policy rate. According to the chamber, this will encourage borrowing among industries, businesses and individuals, thereby increasing investment and spending. However, Rathi cautioned that NRB must remain vigilant against potential capital flight if deposit rates are lowered.

The chamber observed that the policy calls for the revision of working capital loan guidelines for agriculture, small and cottage industries, aligning them with the nature of each business and its income cycle. CIM stated it would monitor whether this provision is implemented effectively.

CIM also noted that the policy does not cover large industries or several key sectors and fails to provide general loan rescheduling for businesses struggling with repayments.

The chamber welcomed NRB’s commitment to study and update loan classification and loan-loss management practices in line with international standards and urged the central bank to implement these changes swiftly.

Additionally, CIM expressed support for the proposed system that would allow authorised institutions to electronically access customer details once updates are made at any bank. This measure would eliminate the need for repeated document submissions for know-your-customer updates across financial institutions.

The chamber reiterated that it was the first to advocate for the establishment of an asset management company (AMC). Although the previous policy made provisions for an AMC, legislation enabling its formation has not yet been passed. CIM called for the immediate enactment of such a law.

CIM further stated that the policy remains silent on issues affecting export-oriented industries and startups. It criticised the inconsistent nature of the policy—alternating between loose and tight approaches—which it said creates uncertainty for foreign investors. The chamber emphasised the need for a stable and predictable policy framework.

-1769441547.jpg)