Between July 14 and August 13, the Nepal Stock Exchange (NEPSE) Index rose by 23.78 points (+0.86%) to close at 2,785.74 points. In the early part of the review period, the index gained steadily and crossed 3,000 points to reach a peak of 3,002.07 points on July 29. However, the market could not sustain the gain and declined continuously thereafter, though it remained above the opening level of 2,761.96 points. Compared to the previous review period, which saw a 23% increase in total transaction volume (turnover), this review period recorded a notable 62% rise. This suggests a market sentiment that is optimistic but measured.

See Figure 1

-1758188400.jpg)

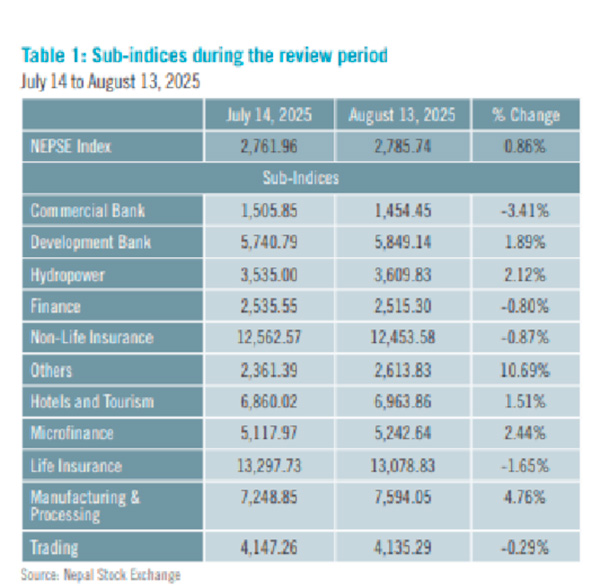

During the review period, five of the 11 sub-indices ended in the red zone, while the remaining six recorded gains. The strongest performers were Manufacturing and Processing, Microfinance, and Others sub-sectors, while Commercial Banks, Non-Life Insurance, and Life Insurance sub-sectors saw the largest negative results.

The Others sub-index (+10.69%) was the top gainer, driven by a substantial increase in the share prices of recently listed Trade Tower (+Rs 962.35), Nepal Reinsurance (+Rs 246.18) and Muktinath Krishi (+Rs 148.33). It was followed by Manufacturing and Processing sub-index (+4.76%), with a rise in share prices of Unilever Nepal (+Rs 999), Shivam Cement (+Rs 108.44) and Himalayan Distillery (+Rs 93.76).

Next, the Microfinance sub-index (+2.44%) gained as share prices of Samaj (+Rs 511.32), Infinity (+Rs 341.96) and Mahuli Samudayik Laghubitta (+Rs 264.47) increased. The Hydropower sub-index (+2.12%) also rose, supported by a rise in share prices of Sanvi Energy (+Rs 713.54), Three Star Hydropower (+Rs 144.24) and Bindhyabasini Hydropower (+Rs 101.35).

Likewise, the Development Bank sub-index (+1.89%) was next in line, with a rise in the share prices of Lumbini Bikas Bank (+Rs 107.08), Muktinath Bikas Bank (+Rs 40.58) and Kamana Sewa Bikas Bank (+Rs 351.8). Meanwhile, the Hotels and Tourism sub-index (+1.51%) gained marginally, led by the increase in share price of Chandragiri Hills (+Rs 27.32).

On the downside, the Trading sub-index (-0.29%) fell as Salt Trading (-Rs 100.78) and Bishal Bazar Company (-Rs 8.7) dropped in share value. The Finance sub-index (-0.80%) also declined, with a drop in share prices of Samriddhi Finance (-Rs 48.92), Shree Investment and Finance (-Rs 23.52) and Central Finance (-Rs 21.6). The Non-life Insurance sub-index (-0.87%) followed with a decrease in share prices of Prabhu Insurance (-Rs 142.48), Nepal Insurance (-Rs 33.25) and Himalayan Everest Insurance (-Rs 24.48). Similarly, the Life Insurance sub-index (-1.65%) posted losses, driven by declines in share prices of Guardian Micro-Life Insurance Company (-Rs 158.31), Crest Micro Life Insurance (-Rs 54) and Sun Nepal Life Insurance Company (-Rs 27.03). Finally, the Commercial Bank sub-index (-3.41%) was the biggest loser of the period, led by drops in the share prices of NIC Asia (-Rs 34.92), Nepal SBI Bank (-Rs 32.31) and Standard Chartered Bank (-Rs 27.68). (See Table 1)

News and Highlights

On July 14, CDS and Clearing (CDSC) proposed the ‘Securities Dematerialisation Operational Guidelines 2082’ to the Securities Board of Nepal (SEBON). The proposal recommended assigning separate International Securities Identification Numbers (ISINs) for promoter shares and general public shares, preventing the automatic conversion of promoter shares into public shares after a three-year lock-in period. However, Nepal Chamber of Commerce and Independent Power Producers Association Nepal strongly opposed the new ISIN system. Separately, Hem Raj Dhakal, Vice President of Federation of Nepalese Chambers of Commerce and Industry, was appointed as a board member of SEBON to represent the private sector.

Nepal Stock Exchange also introduced a key update effective July 17, allowing investors to access market depth data for odd-lot transactions involving fewer than 10 shares. This enables small investors to buy and sell odd lots more easily, promoting greater market transparency and accessibility.

esides this, on July 14, a three-member banking sector reform task force presented its final report to Nepal Rastra Bank. The report proposes measures to strengthen banking regulations, improve rural credit access, address merger challenges, support economic growth, enhance capital markets, and work toward removing Nepal from the international grey list. The report’s details have not yet been disclosed.

In line with these reform efforts, NRB has taken concrete steps to address banking sector challenges and stimulate economic activity. As of August 10, the average Credit to Deposit (CD) ratio of banks and financial institutions stood at 76.07%, indicating that only three-fourths of deposits were being lent, resulting in excess market liquidity. To manage this, NRB absorbed Rs 320 billion from BFIs during the review period. To further utilise the available liquidity and boost credit flow, the new monetary policy increased the margin loan limit for individual investors to Rs 250 million, up by Rs 100 million from the previous year. Additionally, to strengthen regulatory oversight, NRB appointed Howladar Yunus & Co, a Bangladeshi audit firm, to conduct an extensive asset quality review of the ten largest commercial banks.

SEBON approved the Initial Public Offering (IPO) of six companies during the review period, from July 14 to August 13: Swastik Laghubitta Bittiya Sanstha, Bungal Hydro, Bandipur Cable Car and Tourism, Jhapa Energy, Sagar Distillery and Shreenagar Agritech Industries. Swastik Laghubitta plans to raise Rs 23.1 million through the issue manager Nabil Investment Banking. Bungal Hydro has assigned Himalayan Capital as the issue manager to raise Rs 290.5 million. Similarly, Bandipur Cable Car is planning to raise Rs 586 million with the issue manager Nepal SBI Merchant Banking. Likewise, Jhapa Energy will raise Rs 95.05 million with Himalayan Capital as the issue manager. SEBON approved the remaining two IPOs in the new fiscal year, which started from July 17. Both of the companies are from the manufacturing and processing sectors. Meanwhile, Sagar Distillery plans to raise Rs 145.2 million, with Muktinath Capital as the issue manager, while Shreenagar Agritech is planning to raise Rs 326.25 million, with Nabil Investment Banking as the issue manager.

Outlook

Excess liquidity and lower credit demand could be reflected in the market turnover. Moreover, the optimistic investor sentiment driven by the expansionary monetary policy has been further strengthened by the better-than-expected earnings of key listed companies from the previous fiscal year. As a result, the combination of an increased margin loan limit and lower interest rates is expected to drive heightened buying pressure in the market.

This is an analysis from beed Management. No expressed or implied warranty is made for the usefulness or completeness of this information, and no liability will be accepted for the consequences of actions taken based on this analysis.