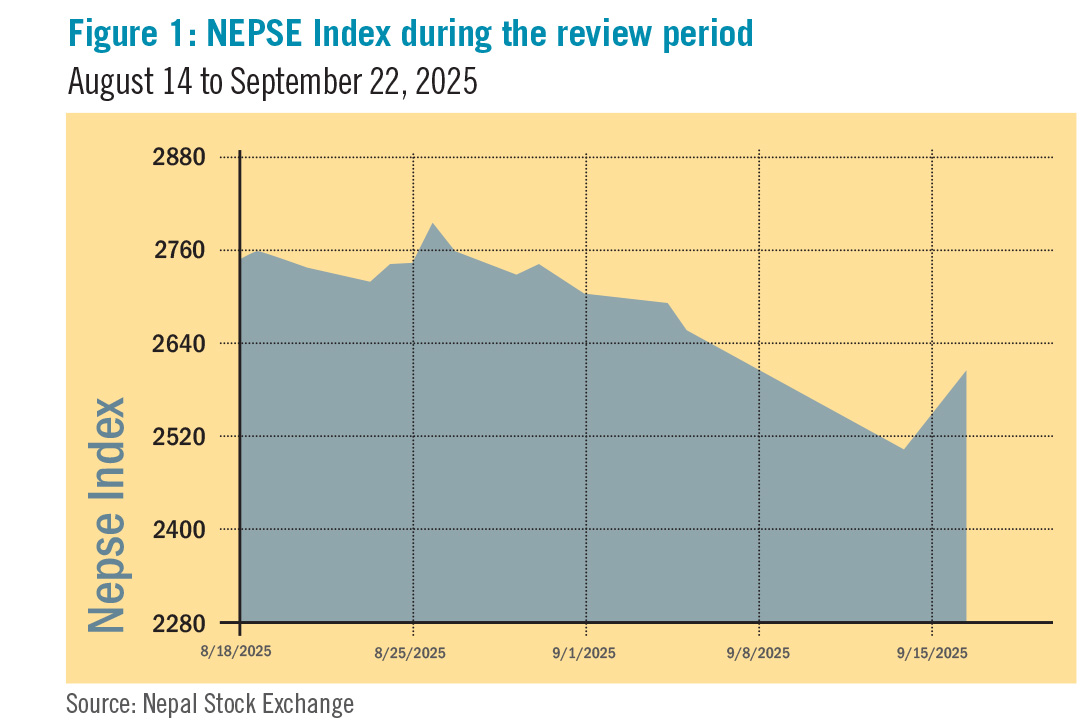

The Nepal Stock Exchange (NEPSE) index fell by 165.92 points (-5.95%) to close at 2,623.62 points over the period from August 14 to September 22. The period began with relative stability, as the index opened at 2,770.39 and reached a peak of 2,819.10 points on August 27. However, these gains proved unsustainable, and the market declined continuously thereafter. The downturn culminated on September 18, when the index plummeted to its lowest point of 2,511.91, a fall of 6%, as the market reopened after nine days of closure following the nationwide protests. Likewise, compared to the previous review period’s 62% increase in total transaction volume (turnover), this period saw a staggering 64% fall. This sharp decline in the secondary market volume suggests an erosion of investor confidence, fuelled by a heightened perception of risk stemming from political instability. (see figure 1)

During the review period, all 11 sub-indices declined. Manufacturing and Processing, Development Bank, and Commercial Bank sub-sectors experienced relatively smaller losses, while the worst performers were Non-Life Insurance, Hotels and Tourism, and Others sectors.

Non-Life Insurance sub-index (-11.81%) experienced the largest decline, as the share prices of Nepal Micro Insurance (-Rs 414.47), Rastriya Beema Company (-Rs 387.21) and Shikhar Insurance (-Rs 125.23) declined in value. Next in line, the Hotels and Tourism sub-index (-8.34%) declined with a fall in share prices of Oriental Hotels (-Rs 149.96), Kalinchowk Darshan (-Rs 124.63) and Taragaon Regency Hotel (-Rs 87.58). The Others sub-index (-7.33%) followed with a decrease in share prices of Trade Tower (-Rs 216.93), Muktinath Krishi Company (-Rs 144.39) and Himalayan Re-Insurance (-Rs 121.96).

The Trading sub-index (-7.01%) also had an overall loss, driven by a decline in share prices of Bishal Bazar Company (-Rs 415.52), even though Salt Trading Corporation (+Rs 123.08) saw a rise in its share price. Hydropower sub-index (6.47%) was next in line, with a fall in share prices of Sikles Hydropower (-Rs 242.37), Kutheli Bukhari Small Hydropower (-Rs 141) and Super Madi Hydropower (-Rs 125.81). Likewise, Finance sub-index (-6.09%) also declined as the share prices of Nepal Finance (-Rs 71.02), Goodwill Finance (-Rs 56.35) and Multipurpose Finance (-Rs 55.56) fell.

The Microfinance sub-index (-5.92%) dropped with a fall in share prices of Mahila Laghubitta (-Rs 248.5), Gurans Laghubitta (-Rs 237.48) and Unique Nepal Laghubitta (-Rs 232). It was followed by Life Insurance sub-index (-4.96%), driven by a fall in share prices of Crest Micro Life Insurance (-Rs 262.47), Life Insurance Corporation (-Rs 41.73) and Guardian Micro-Life Insurance (-Rs 40.8).

Among the sectors with relatively smaller losses, the Commercial Bank sub-index (-4.69%) declined slightly with a fall in the share prices of NIC Asia (-Rs 39.06), Nepal Bank (-Rs 33.89) and Sanima Bank (-Rs 31.23). Likewise, Development Bank sub-index (-3.90%) had a marginal loss led by drop in share prices of Narayani Development Bank (-Rs 848.13), Green Development Bank (-Rs 157.54) and Sindhu Bikash Bank (-Rs 108.12).

Manufacturing and Processing sub-index (-3.89%) had the least loss during the review period, with a fall in the share prices of Bottlers Nepal (-Rs 1,563.09), Om Megashree Pharmaceuticals (-Rs 204.4) and Shivam Cement (-Rs 47.07). (see table 1)

-1761904714.jpg)

News and Highlights

The political unrest on September 8 and 9 had a direct and severe impact on Nepal Stock Exchange. In accordance with the Securities Act 2063, the market remained closed for nine trading days, from September 9 to September 17. Upon reopening on September 18, NEPSE endured one of its most volatile sessions as investors rushed to sell off their positions amidst fear of uncertainty. The benchmark index plummeted by 6% (160.33 points), triggering all three phases of the circuit breaker mechanism within minutes and culminating in a full-day trading halt.

Securities Board of Nepal (SEBON) suspended the 15-minute weighted average price system on September 19 reverting to the previous method of using the last traded price as the official closing price. The revised rule, which took effect on September 23 after a test on September 21, is devised to prevent bulk trades from exerting disproportionate influence on the final price. Following this reversal, NEPSE experienced a sharp rebound on September 21, with the index climbing 111.70 points (4.44%) as investor confidence returned.

Additionally, on September 7, NEPSE introduced stricter disclosure requirements. A key measure mandates that listed companies must promptly inform NEPSE if any investor acquires more than 5% of their shares, a rule intended to prevent stock price distortion from concentrated bulk purchases. The directive also enforces stricter reporting timelines, requiring audited financial statements within five months of the fiscal year’s close and quarterly reports within a month of the quarter’s end. Further, firms must notify NEPSE at least seven days before book closure for general meetings and immediately disclose major corporate moves, such as significant asset transactions or board changes. These measures, which cover 19 categories of information in total, form part of NEPSE’s effort to enhance corporate accountability.

The Share Investors Association of Nepal, Nepal Capital Market Investors Association, and Independent Capital Market Investors Association presented 23 demands to Finance Minister Rameshore Khanal’s task force on September 21, seeking reforms to strengthen investor morale and market stability. They demand the removal of the Rs 250 million ceiling on individual single-family loans and a revision of capital gains tax to 3% for long-term and 5% for short-term investors, which is also to be treated as a final tax. Other proposals include eliminating the double commission system on transactions, removing the additional 5% tax on dividends distributed by banks and financial institutions, and revising the 25% dividend distribution cap for microfinance institutions. Investors also urge expansion of brokerage services in all 77 districts, modernisation of NEPSE’s online trading platform, timely implementation of SME securities, and simplified processes for non-resident Nepalis to repatriate investments and profits.

During the review period from August 14 to September 21, SEBON approved the Initial Public Offering (IPO) of SY Panel Nepal. The company plans to raise Rs 523.25 million through the issue manager Prabhu Capital. SEBON also approved NMB Saral Bachat Fund – E, an open-end Mutual Fund managed by NMB Capital. Similarly, applications were received for other mutual funds, including Nepal Life Samriddhi Lagani Yojana (close end) and Muktinath Mutual Fund 2 (close end) filed through Nepal Life Capital and Muktinath Capital, respectively.

Outlook

Nepal’s stock market faces an uncertain outlook in the wake of the recent political crisis. Although new regulations and the formation of an interim government have helped calm investors, the market remains fragile. During this interim phase, investor confidence is likely to stay highly sensitive to any fresh signs of instability. However, responding to or taking note, the 23 demands put forward by the investors could ease some concerns and offer short-term stability.

This is an analysis from beed Management. No expressed or implied warranty is made for the usefulness or completeness of this information, and no liability will be accepted for the consequences of actions taken based on this analysis.