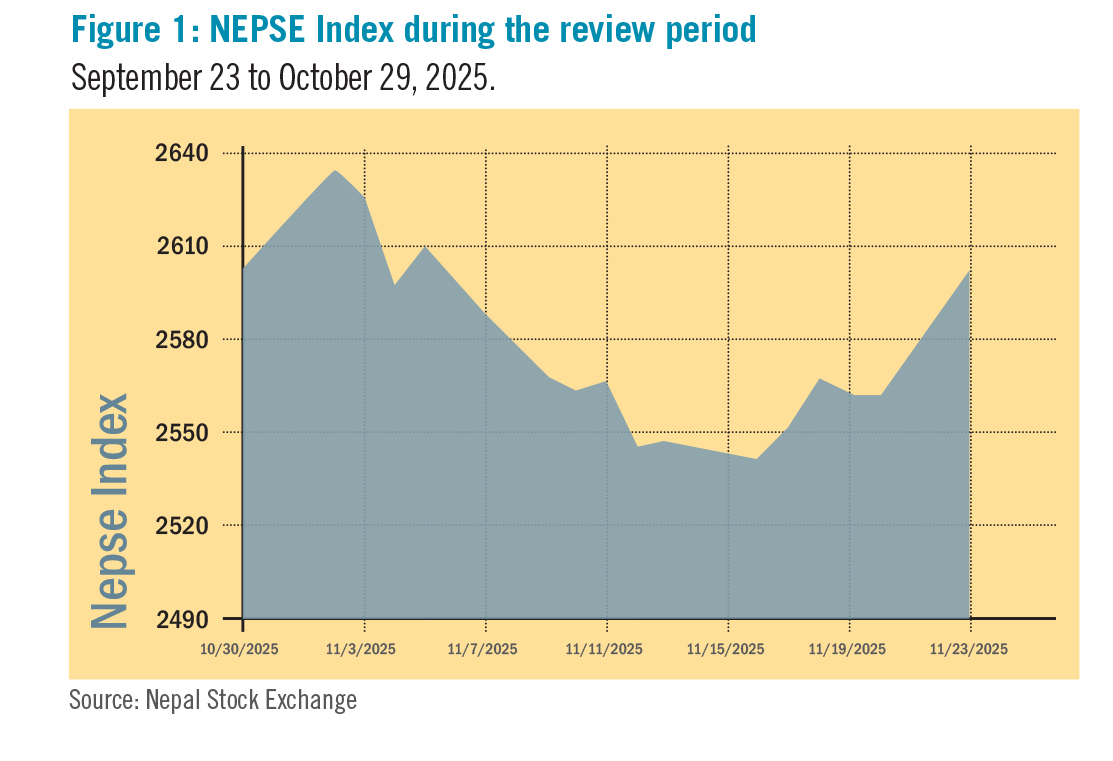

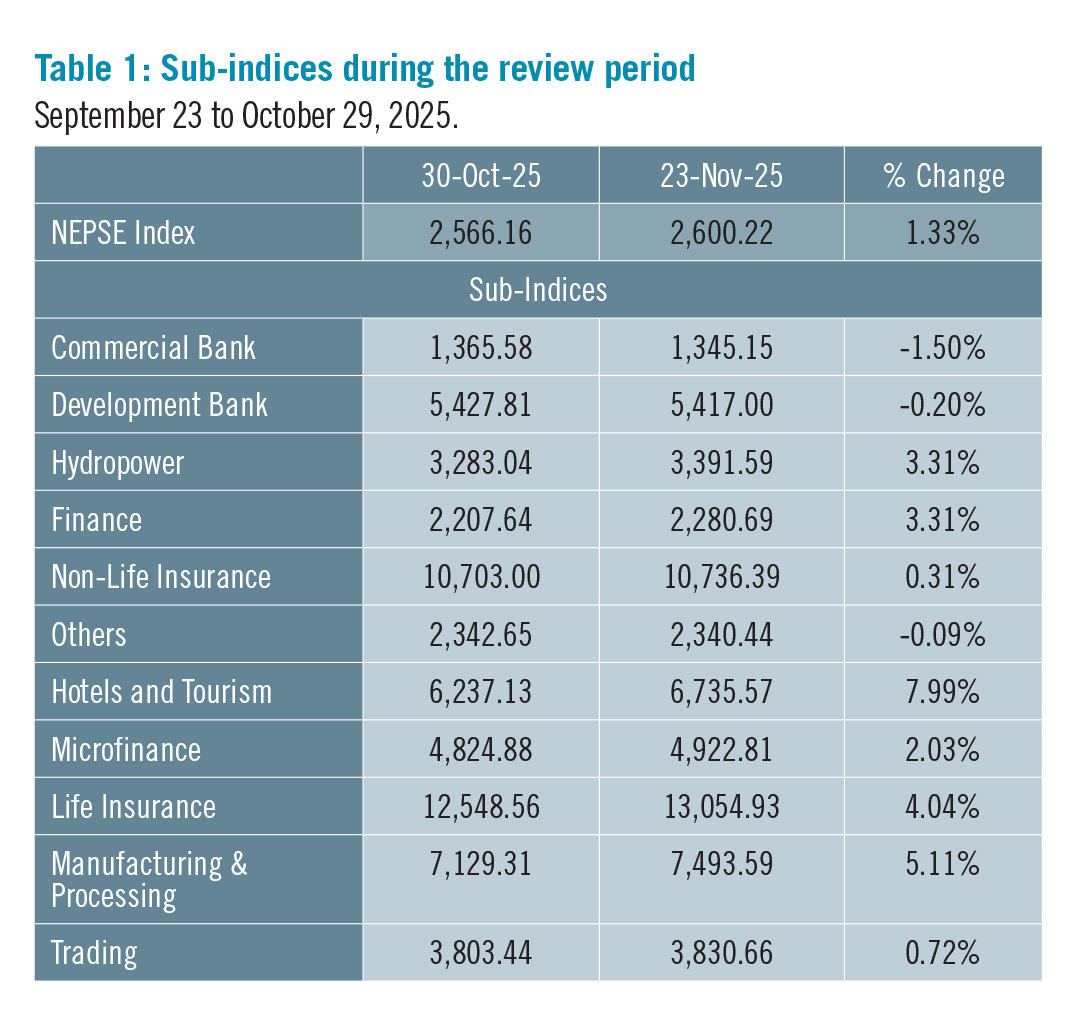

The Nepal Stock Exchange (NEPSE) index rose by 34.06 points (1.33%) to close at 2,600.22 points during the period from October 30 to November 23. The index, which had closed at 2,566.16 points in the previous review period, moved upward to a high of 2,622.89 on November 3. This gain was followed by a downward trajectory, with the index touching its monthly low of 2,540.57 points on November 16. In the final days of the month, the market showed signs of stabilisation and modest recovery. Meanwhile, monthly turnover rose by 25% compared to the previous review period, offsetting the 40% decline seen earlier. Overall, the month’s movements signal a cautiously improving investors sentiment. (See Figure 1)

During the review period, performance was mixed across sectors. Three sub-indices, including Commercial Bank, Development Bank and Others registered losses. The remaining sub-indices recorded gains.

The Hotels and Tourism sub-index (+7.99%) recorded the largest gain during the review period. This gain was driven by a notable increase in the share prices of Bandipur Cable Car and Tourism (+Rs 671.5), Chandragiri Hills (+Rs 35) and City Hotel (+Rs 4). Similarly, Manufacturing and Processing sub-index (+5.11%) also saw a rise in the share prices of Bottlers Nepal Terai (+Rs 1,509.9), Bottlers Nepal Balaju (+Rs 1,290) and Sagar Distillery (+Rs 910.8). Following that, Life Insurance sub-index (+4.04%) also increased due to the rise in share prices of Life Insurance Corporation Nepal (+Rs 59.8), Nepal Life Insurance (+Rs 53) and Sun Nepal Life Insurance (+Rs 31). Finance sub-index (+3.31%) was next in line as the share value of Multipurpose Finance (+Rs 36.8), Gurkhas Finance (+Rs 32.4) and Best Finance Company (+Rs 28.5) increased.

Similarly, Hydropower sub-index (+3.31%) also recorded gains primarily driven by the rise in share prices of Mabilung Energy (+Rs 703.2), Bungal Hydro (+Rs 579.9) and Daramkhola Hydro Energy (+Rs 556). Microfinance sub-index (+3.02%) came next with a rise in share prices of Deprosc Laghubitta (+Rs 855), Swastik Laghubitta (+Rs 566.5) and Mahuli Laghubitta (+Rs 150.9). The Trading sub-index (+0.72%) had a slight increase with share prices of both Salt Corporation (+Rs 238.9) and Bishal Bazar Company (+Rs 19) seeing a rise. Non-Life Insurance sub-index (+0.31%) recorded a marginal gain, with the rise in share prices of Shikhar Insurance (+Rs 17.9), Neco Insurance (+Rs 13.9) and Rastriya Beema Company (+Rs 10).

Among the sectors that marked losses, Others sub-index (-0.09%) saw a mild decline reflecting decrease in the share prices of Muktinath Krishi Company (-Rs 145), Nepal Reinsurance (-Rs 39) and a slight increase in Nepal Doorsanchar (+Rs 2.6). The Development Bank sub-index (-0.20%) followed next as the share prices of Corporate Development Bank (-Rs 67), Garima Bikas Bank (-Rs 34) and Muktinath Bikas Bank (-Rs 19.1) declined. Commercial Bank sub-index (-1.50%) was the worst performer, led by the fall in share prices of Siddhartha Bank (-Rs 31.1), Citizens Bank (-Rs 22.9) and Global IME Bank (-Rs 22). (See Table 1)

News and Highlights

Nepal’s financial and capital markets continued to experience strain, reflecting the broader economic uncertainty that has followed the Gen Z protests. Commercial banks continued to face deteriorating asset quality, with Non-Performing Loans (NPLs) rising sharply across the sector. Average NPLs reached 4.86%, with Himalayan Bank posting the highest ratio at 7.39%. The elevated defaults forced banks to set aside an additional Rs 11 billion in loan-loss provisions. As a result, the industry’s combined net profit declined by 18.67%, falling to Rs 13.14 billion.

Private sector borrowing also experienced a considerable slowdown. Nearly Rs 1.1 trillion in loanable funds remained idle in the banking system due to limited credit demand and uncertainty over investment conditions. This was reflected in the domestic credit growth of just 0.5% in the first three months of the current fiscal year, a notable slowdown from the 1.7% growth recorded in the same period last year. The persistently low borrowing occurred despite a relatively accommodative interest rate environment, where the average base rates for commercial banks, development banks and finance companies stood at 5.56%, 7.92% and 8.48%, respectively, suggesting that risk aversion and economic uncertainty are significant constraints amid weak confidence.

Parallel to the banking sector’s challenges, the capital market faced operational standstill through early November. Employees of the Securities Board of Nepal (SEBON) ended their nearly seven-week protest on November 9 after the Ministry of Finance formed a committee to address their demands. The strike, which began on September 23, had halted public issuance processes worth an estimated Rs 80 billion, affecting close to 100 companies awaiting regulatory clearance.

With SEBON resuming its operation, SEBON approved the Initial Public Offering (IPO) of Solu Hydropower within the review period. The company plans to raise Rs 2 billion through the issue managers Nabil Investment Banking and Himalayan Capital. Similarly, Electro Power Company and NC Agro Tech Industries applied at SEBON to issue an IPO through NIMB Ace Capital and Global IME Capital, respectively. Electro aims to raise Rs 812.5 million while NC Agro aims to raise Rs 187.7 million.

Outlook

Credit demand remains weak, NPLs are rising and confidence is low. While SEBON’s full resumption may revive stalled issuances, recovery will be gradual. Clearer policy direction and stronger investor confidence are crucial for momentum to return.

This is an analysis from beed Management. No expressed or implied warranty is made for the usefulness or completeness of this information, and no liability will be accepted for the consequences of actions taken based on this analysis.