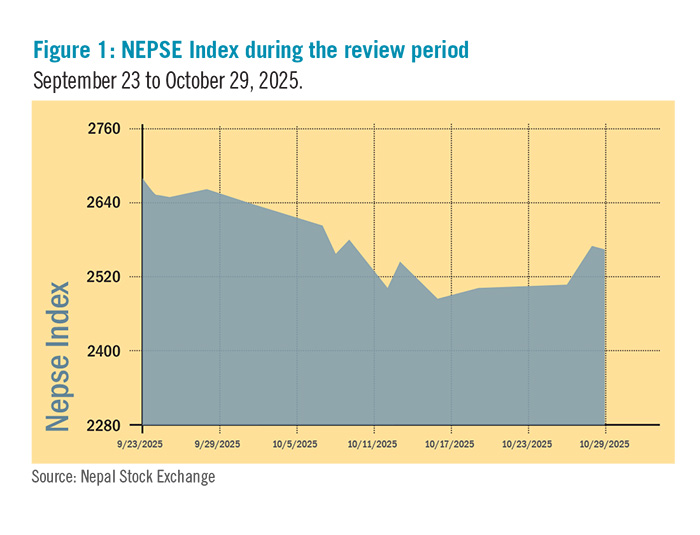

The Nepal Stock Exchange (NEPSE) index declined by 64.96 points (-2.47%) to close at 2,566.16 points between September 23 and October 29, 2025. The index opened at 2,631.12 and continued to fall, recording its lowest point of 2,487.17 points on October 16. It stabilised afterwards, showing slight recovery toward the end of the period. Similarly, total market volume decreased by 40% from the last review period, a less severe decline than the 64% drop experienced in the period prior. This modest recovery suggests that the market is beginning to regain footing as political tensions ease, though it remains fragile and highly sensitive to further uncertainty. (See Chart 1)

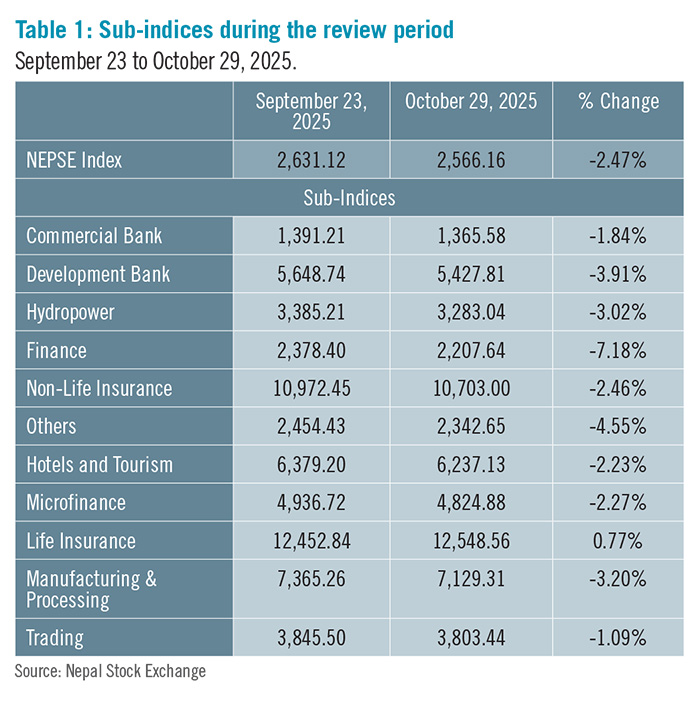

During the review period, 10 sub-indices remained in negative territory, with only the Life Insurance sub-sector posting a marginal gain. Among the losers, Trading and Commercial Bank sectors experienced relatively smaller losses, whereas Finance, Development Bank and Others sub-sectors were the weakest performers.

The Life Insurance sub-index (+0.77%) was the only one to gain during the review period. This gain was driven by a notable increase in the share prices of Crest Micro Life Insurance (+Rs 249.59), Reliable Nepal Life Insurance (+Rs 23.61) and National Life Insurance (+Rs 21.24).

Conversely, the Finance sub-index (-7.18%) saw the largest decline, as the share prices of Manjushree Finance (-Rs 80.04), Multipurpose Finance (-Rs 51.87) and Samriddhi Finance (-Rs 49) fell considerably. Following that, Others sub-index (-4.55%) decreased due to declines in the share prices of Nepal Reinsurance Company (-Rs 101.67), Himalayan Re-Insurance (-Rs 76.55) and Trade Tower (-Rs 35.42). The Development Bank sub-index (-3.91%) also dropped, driven by decreases in share prices of Corporate Development Bank (-Rs 183.02), Kamana Sewa Bikas Bank (-Rs 79.79) and Muktinath Bikas Bank (-Rs 78.84). Similarly, Manufacturing and Processing sub-index (-3.20%) declined, primarily driven by the fall in share prices of Bottlers Nepal (-Rs 500), Unilever Nepal (-Rs 300) and Bottlers Nepal Terai (-Rs 110.56). The Hydropower sub-index (-3.02%) was next in line, with a fall in share prices of Bhagwati Hydropower (-Rs 86.77), Three Star Hydropower (-Rs 78.88) and Sikles Hydropower (-Rs 72.79). Likewise, Non-Life Insurance sub-index (-2.46%) also declined as the share prices of Rastriya Beema Company (-Rs 197.79), Siddhartha Premier Insurance (-Rs 74.97) and Himalayan Everest Insurance (-Rs 41.33) fell.

Next, the Microfinance sub-index (-2.27%) also recorded a decline, with drops in share prices of Mahuli Laghubitta (-Rs 163.3), Samudayik Laghubitta (-Rs 140.19) and Ganapati Laghubitta (-Rs 130). Hotels and Tourism sub-index (-2.23%) followed next as the share prices of Taragaon Regency Hotel (-Rs 113.58), City Hotel (-Rs 57.73) and Chandragiri Hills (-Rs 49.08) declined.

Among the sectors with comparatively smaller losses, the Commercial Bank sub-index (-1.84%) saw a mild decline, reflecting decreases in the share prices of Everest Bank (-Rs 79.96), Sanima Bank (-Rs 19.34) and Machhapuchchhre Bank (-Rs 18.92). Similarly, Trading sub-index (-1.09%) also had a marginal loss, led by the fall in share prices of both Salt Corporation (-Rs 120.06) and Bishal Bazar Company (-Rs 49.28). (See Table 1)

News and Highlights

The Securities Board of Nepal (SEBON) faced significant regulatory and institutional disruptions after the Ministry of Finance, on September 18, ordered the suspension of SEBON’s Employees Welfare Fund and Employees Security Fund. The ministry also directed the recovery of previously disbursed amounts, with some retired employees required to return up to Rs 8 million. The decision triggered an employee protest demanding the restoration of SEBON’s autonomy and the withdrawal of the ministry’s directive. Amid the deadlock, Ministry of Finance replaced its representative on SEBON’s board, appointing Senior Joint Secretary Uttar Khatri in place of Mahesh Baral.

Despite the internal turmoil, SEBON began implementing a nine-point action plan formulated by a government task force to stabilise the capital market after the steep decline following the Gen Z movement. The plan outlines short-term reforms, such as revising margin trading rules, clarifying capital gains tax procedures, and standardising investor identification, scheduled for completion by mid- to late-November. Additionally, Nepal Rastra Bank also introduced key policy changes in support of market stability, lifting the Rs 250 million limit on share-backed loans and removing the rule that allowed banks and financial institutions to sell up to 20% of their primary capital in shares after one year. Instead, BFIs must now hold investments in listed shares and debentures for at least six months.

The NEPSE also faced unrest, as employees launched a protest on September 24 demanding a 5% annual profit bonus and the resignation of senior management. The dispute temporarily eased after NEPSE’s Board filed a writ in the Supreme Court seeking legal interpretation of the bonus provision, prompting the employees’ union to suspend the strike starting October 30.

As a result of these overlapping disruptions, SEBON did not approve any new Initial Public Offerings during the period. Currently, 75 companies, including 37 hydropower firms, are awaiting SEBON’s approval to float 375.4 million units of ordinary shares worth Rs 54.15 billion. On the other hand, the Independent Power Producers’ Association of Nepal (IPPAN) has issued a 15-day ultimatum, claiming that regulatory delays have cost the hydropower sector more than Rs 108 billion.

Outlook

Declining interest rates are driving higher market participation, evidenced by the sustained growth in market turnover. Supportive regulatory changes have further strengthened this upward trend, suggesting a cautious revival of investor confidence. Nonetheless, the market remains in a transitional phase, with several underlying vulnerabilities persisting.

This is an analysis from beed Management Pvt Ltd. No expressed or implied warranty is made for the usefulness or completeness of this information, and no liability will be accepted for the consequences of actions taken based on this analysis.