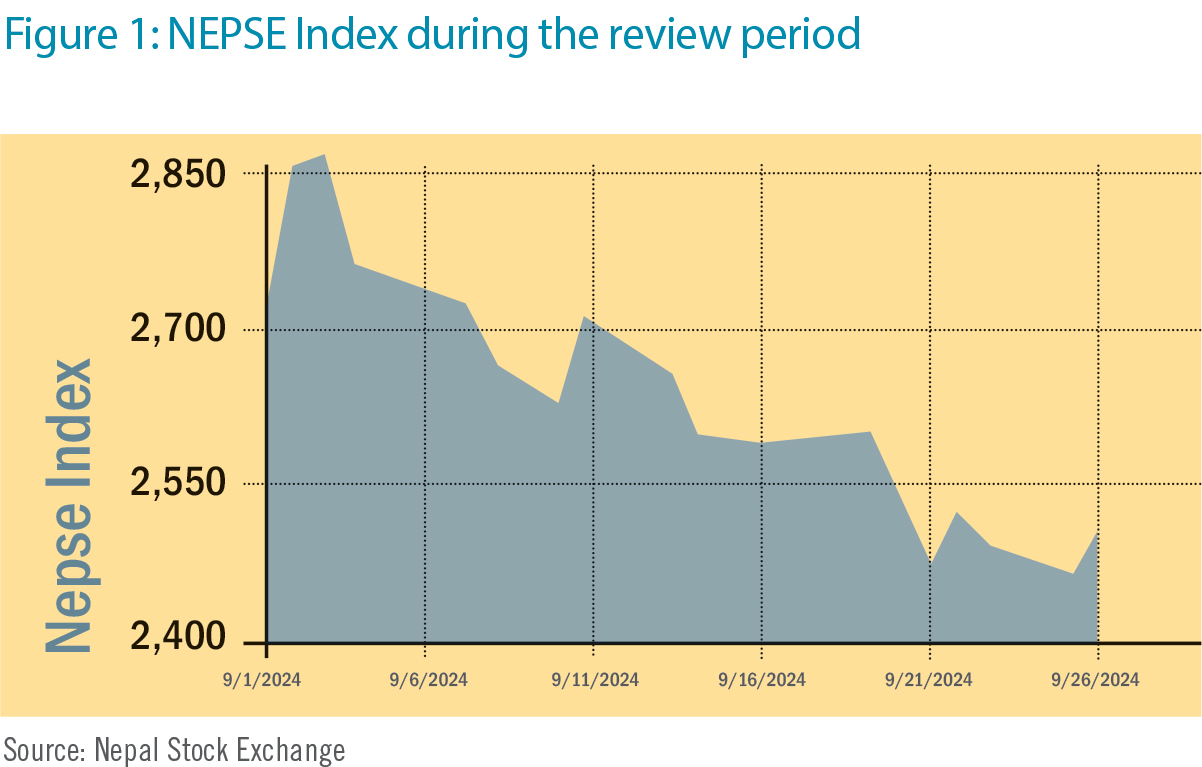

The Nepal Stock Exchange (NEPSE) index fell by 240.76 points (-8.76%) to close at 2,508.86 points during the review period between September 1 and September 30. Despite strong upward movements observed in the preceding months, it lost ground during this period reaching its lowest at 2,464.40 points on September 29. The market continued to decline despite lowered interest rates as investors felt selling pressure due to the upcoming festivities. The overall market volume during the review period dropped to Rs 158.83 billion, a 61% decrease.

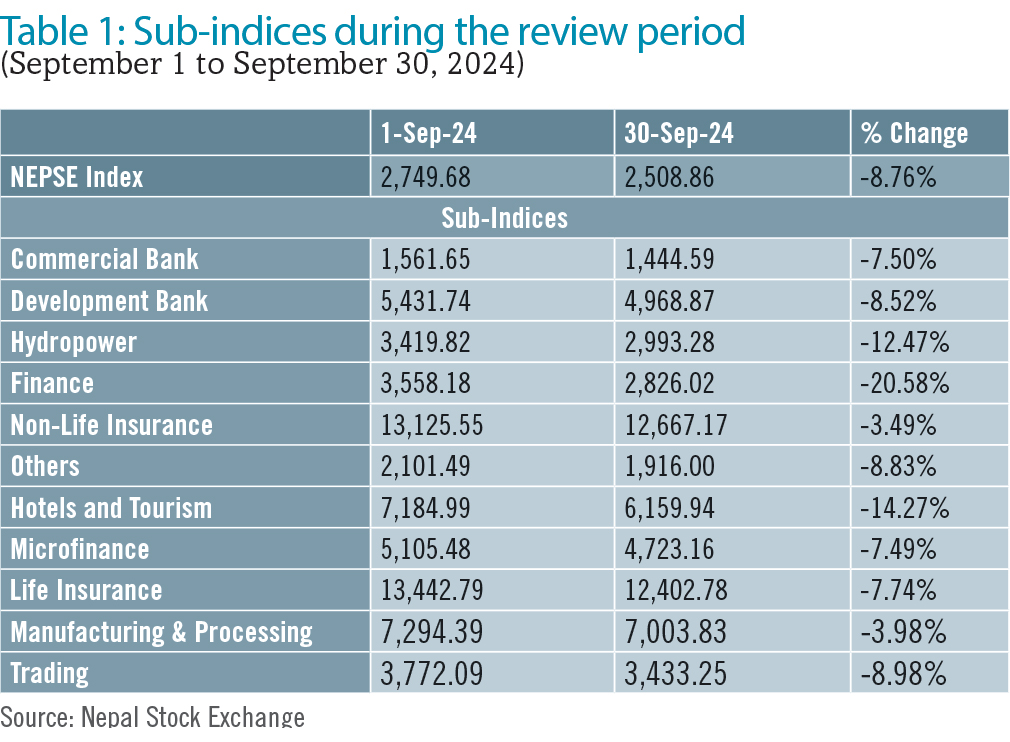

During the review period, all 11 sub-indices fell into the red zone.

Finance sub-index (-20.58%) was the biggest loser as the share value of Nepal Finance (-Rs 680.2), Goodwill Finance (-Rs 336) and Multipurpose Finance (-Rs 144.9) decreased substantially. Hotels and tourism sub-index (-14.27%) was second in line as the share value of Taragaon Regency Hotel (-Rs 261), Oriental Hotels (-Rs 199) and City Hotels (-Rs 118) declined.

Similarly, Hydropower sub-index (-12.47%) saw a drop in the share prices of Three Star Hydropower (-Rs 377.9), Mandu Hydropower (-Rs 234.4) and Mai Khola Hydropower (-Rs 213). Trading sub-index (-8.98%) saw a decline in the share prices of Salt Trading Corporation (-Rs 550) and Bishal Bazar (-Rs 424). Others sub-index (-8.83%) followed suit with a drop in the share prices of Muktinath Krishi (-Rs 155), Nepal Warehousing (-Rs 130.1) and Himalayan Reinsurance (-Rs 103). Similarly, the Development Bank sub-index (-8.52%) saw a drop in share prices of Miteri Development (-Rs 133.1), Karnali Development (-Rs 125) and Green Development (-Rs 91.3).

Life Insurance sub-index (-7.74%) also fell as share value of Life Insurance Corporation Nepal (-Rs 214), Sanima Reliance Life Insurance (-Rs 118) and National Life Insurance (-Rs 87.3) went down. Commercial Bank sub-index (-7.50%) also witnessed a decline as the share prices of Everest Bank (- Rs 155), Nabil Bank (-Rs 55) and NIC Asia Bank (-Rs 54) went down.

The Microfinance sub-index (-7.49%) went down as share prices of Upakar Microfinance (-Rs 380), Jeevan Bikas Microfinance (-Rs 197.1) and Himalayan Microfinance (-Rs 190) declined. Manufacturing and Processing sub-index (-3.98%) saw a dip with decline in share values of Bottlers Nepal-Terai (-Rs 930), Himalayan Distillery (-Rs 122.5) and Sarbottam Cement (-Rs 44.9). Non-life Insurance sub-index (-3.49%) also saw a decline in share prices of Rastriya Beema (-Rs 1,234), Shikhar Insurance (-Rs 97.2) and Himalayan Everest Insurance (-Rs 64).

News and Highlights

Following public concerns, the government has shared plans of prohibiting civil servants from engaging in share trading during office hours. The decision comes after a formal request from the Commission for the Investigation of Abuse of Authority to the Prime Minister’s Office stating complaints of employees prioritising trading over their official responsibilities.

On the public issue front, the Securities Board of Nepal remained unable to approve any new Initial Public Offering due to the continued vacancy of the chairperson’s position.

Outlook

As we approach the end of the first quarter of the current fiscal year and the holiday season approaches, investors are hopeful that the festivities will have a positive effect on the market. However, current climate disasters such as torrential rainfall and widespread flooding have dampened the overall confidence level. As the festive season approaches, selling pressure may mount in the market. Thus, the market will most likely continue following no specific trend, however with the possibility of a positive trajectory as economic activities are likely to pick up post-festivities.