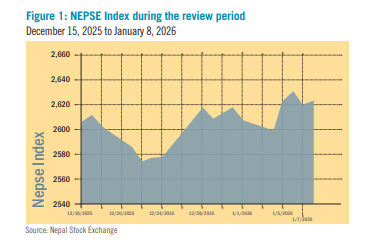

The Nepal Stock Exchange (NEPSE) index increased by 38.93 points (+1.50%) to close at 2,640.54 points during the period from December 15, 2025 to January 8, 2026. The index gained momentum early in the period but failed to sustain the upward trend, falling to an intra-day low of 2,568.94 points on December 23. The market then reversed, reaching an intra-day high of 2,662.66 points on January 6. Finally, the index closed at 2,640.54 points on January 8. Market turnover declined 1% compared to the previous review period, which had seen an 11% decrease. The rise in the index along with relatively steady turnover indicates early signs of improving market sentiment. (see figure 1)

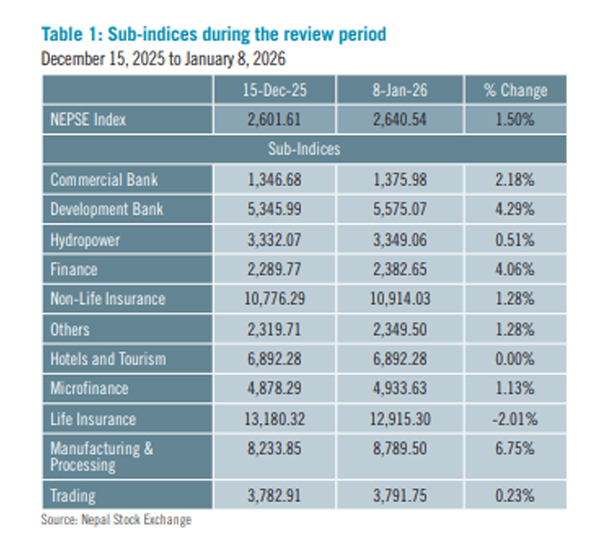

During the review period, all sub-indices recorded gains except the Life Insurance sub-index which was the weakest performer. Manufacturing and Processing, Development Banks, and Finance sub-indices recorded the strongest gains during the period.

Manufacturing and Processing sub-index (+6.75%) had the highest gain largely driven by strong price appreciation in several newly listed companies including SY Panel Nepal (+Rs 790.10), Sagar Distillery (+Rs 208) and Shreenagar Agritech Industries (+Rs 178.9). Development Banks sub-index (+2.33%) ranked second driven by increase in the share prices of Narayani Development Bank (+Rs 383.9), Miteri Development Bank (+Rs 46.8) and Lumbini Bikas Bank (+Rs 28.4). The Finance sub-index (+4.06%) also gained led by Manjushree Finance (+Rs 96), Multipurpose Finance Company (+Rs 84.8) and Goodwill Finance (+Rs 33.9).

Additionally, Hotels and Tourism sub-index (+2.27%) went up with key contributors being Bandipur Cablecar and Tourism (+Rs 68), Taragaon Regency Hotel (+Rs 18) and Soaltee Hotel (+Rs 11). Commercial Banks sub-index (+2.18%) stepped up with appreciation in the share price of Siddhartha Bank (+Rs 47), Sanima Bank (+Rs 30) and NIC Asia Bank (+Rs 17.9).

The Others sub-index (+1.28%) trended upward as well supported by appreciation in two power producers - Jhapa Energy (+Rs 140) and Pure Energy (+Rs 129.9) as well as Muktinath Krishi Company (+Rs 63), an agriculture-based company. The Non-Life Insurance sub-index (+1.28%) gained at a similar percentage, driven by the appreciation in the share prices of Prabhu Insurance (+Rs 28.2), Himalayan Everest Insurance (+Rs 26.9) and Neco Insurance (+Rs 11.5).

Microfinance sub-index (+1.13%) followed with gains in the share price of Swastik Laghubitta Bittiya Sanstha (+Rs 559), Asha Laghubitta Bittiya Sanstha (+Rs 91.1) and CYC Nepal Laghubitta Bittiya Sanstha (+Rs 56.7).

Remaining sub-indices posted gains below 1% during the review period. The gain in the Hydropower sub-index (+0.51%) was supported by capital appreciation in Sanvi Energy (+Rs 155), Him Star Urja Company (+Rs 77) and Sayapatri Hydropower (+Rs 71). Trading sub-index (+0.23%) achieved minimal gain due to an increase in Salt Trading Corporation (+Rs 216).

Life Insurance sub-index (-2.01%) was the only sub-index to decline during the review period as Guardian Micro Life Insurance (-Rs 60.9), Life Insurance Corporation (Nepal) (-Rs 49.1) and Nepal Life Insurance Company (-Rs 46) experienced share price depreciation. (See table 1)

News and Highlights

During the review period, Nabil Bank completed the allotment of 8% Perpetual Non-Cumulative Preference Shares (PNCPS) worth Rs five billion through a private placement to institutional investors. This is the first irredeemable non-cumulative preference shares issued after the introduction of relevant policy provisions by Nepal Rastra Bank (NRB) and Securities Board of Nepal (SEBON). As PNCPS is classified as Additional Tier I Capital under Basel III, it provides BFIs with a cost-efficient instrument to meet capital requirements.

In addition, NRB introduced a new instrument, NRB Bond 2083, to manage excess liquidity in the banking system. Issuance of this one-year bond, which carries semi-annual interest payments, started on December 29, 2025. As of January 8, 2026, NRB has completed six issuances totaling Rs 130 billion.

SEBON approved the Initial Public Offerings (IPOs) for four companies during the review period, including two hydropower companies, one manufacturing and processing company, and one company from the hotels and tourism sector. SEBON approved the IPOs of Super Khudi Hydropower (Rs 310 million) and Shikhar Power Development (Rs 320 million) with Global IME Capital appointed as the issue manager for both offerings. The IPO of Palpa Cement Industries, amounting to Rs 750 million, was also approved, with Nabil Investment Banking as the issue manager. In addition, SEBON approved the IPO of Hotel Forest Inn, which plans to raise Rs 400 million, with NIC Asia Capital as the issue manager. Further, SEBON added one company from hotels and tourism sector, Nagarkot Resort, to the IPO pipeline. The company intends to raise Rs 150 million through a public offering.

Outlook

During this review period, the regulators facilitated the successful issuance of two new instruments, PNCPS and NRB Bond 2083. These regulatory measures, aimed at addressing high cost of capital, excess liquidity, and weak loan demand, can contribute to strengthening market stability and investor confidence.

This is an analysis from beed Management. No expressed or implied warranty is made for the usefulness or completeness of this information, and no liability will be accepted for the consequences of actions taken based on this analysis.