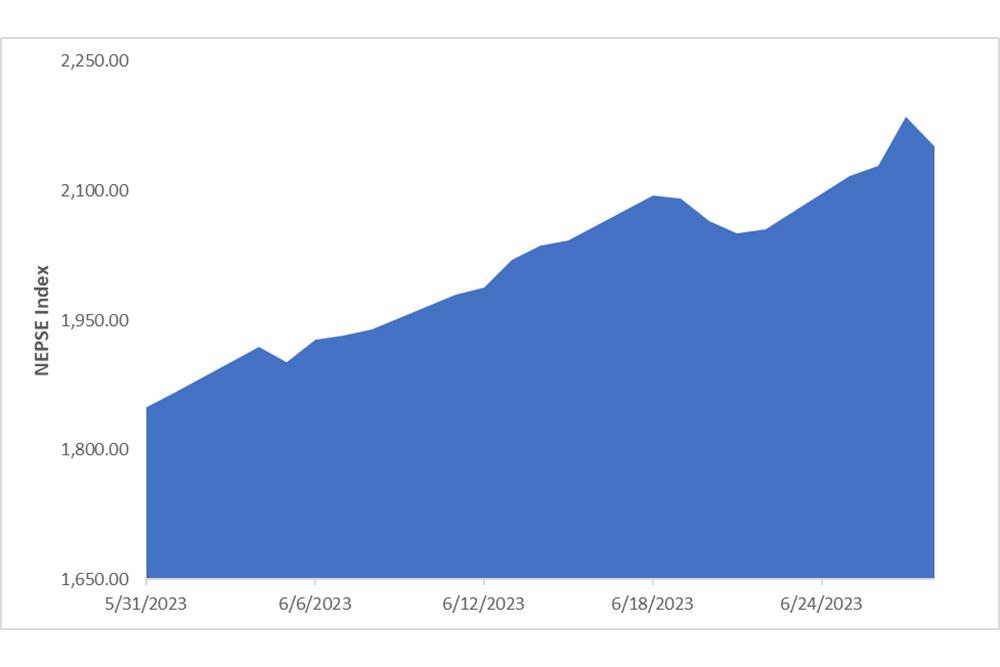

During the review period from May 31 to June 28, 2023, the Nepal Stock Exchange (NEPSE) index went up by a whopping 226.50 points (+14.14%) to close above 2,000 points after three months at 2,150.99 points.

The NEPSE index had a relatively steady and strong upward climb with gradual improvements in the economy and easing of liquidity in the banking system. The latest macroeconomic update for fiscal year 2022/23 showed most of the country’s indicators moving in a positive direction, which led to investors having a positive sentiment for the period. Investor morale was further boosted as interest rates were slashed by the financial institutions. The total market volume during the review period soared significantly by 226.57% with total transactions of Rs 76.817 billion.

During the review period, contrary to the previous period, all 10 sub-indices landed in the green zone, indicating a tremendous recovery across the sub-sectors.

Hotels and Tourism sub-index (+49.75%) was the biggest gainer as the share value of Taragaon Regency (+Rs 238), Kalinchwok Darshan (+Rs 233), and Soaltee (+Rs 207.3) increased substantially. Further, City Hotel started its trading in the review period, closing at Rs 420.7. Life Insurance sub-index (+33.92%) was second in line as it witnessed a rise in the share prices of Life Insurance Co Nepal (+Rs 357), Prabhu Life Insurance (+Rs 243.6) and Asian Life Insurance (+Rs 203). Non-life Insurance sub-index (+27.95%) followed suit with an increase in the share prices of Rastriya Beema (+Rs 1,351), Nepal Insurance (+Rs 307) and NLG Insurance (+Rs 278.9). Likewise, Finance sub-index (+21.75%) also rose as share value of Progressive Finance (+Rs 152.6), Manjushree Finance (+Rs 107) and ICFC Finance (+Rs 106) went up.

|

Table 1 Sub-indices during the review period April 27 to May 30, 2023) |

|||

|

|

31-May-23 |

28-Jun-23 |

% Change |

|

NEPSE Index |

1,884.49 |

2,150.99 |

14.14% |

|

Sub-Indices |

|||

|

Commercial Bank |

1,208.97 |

1,256.83 |

3.96% |

|

Development Bank |

3,426.73 |

3,914.26 |

14.23% |

|

Hydropower |

2,351.65 |

2,530.46 |

7.60% |

|

Finance |

1,554.17 |

1,892.13 |

21.75% |

|

Non-Life Insurance |

8,941.06 |

11,439.91 |

27.95% |

|

Others |

1,338.57 |

1,575.94 |

17.73% |

|

Hotels and Tourism |

3,794.38 |

5,682.04 |

49.75% |

|

Microfinance |

3,456.21 |

4,173.31 |

20.75% |

|

Life Insurance |

9,499.45 |

12,721.22 |

33.92% |

|

Manufacturing & Processing |

4,894.41 |

5,647.03 |

15.38% |

|

Source: Nepal Stock Exchange |

|||

|

|

|||

Similarly, Microfinance sub-index (+20.75%) went up as share prices of BPW Microfinance (+Rs 912.6), Aatmanirbhar Microfinance (+Rs 672.6) and National Microfinance (+Rs 337) increased. Others sub-index (+17.73%) also surged with a rise in the share value of Citizen Investment Trust (+Rs 443), Nepal Telecom (+Rs 140.1) and National Reinsurance (+Rs 80.8).

Source: Nepal Stock Exchange

Along the same lines, Manufacturing and Processing sub-index (+ 15.38%) witnessed a rise in the share prices of Bottlers Nepal (+Rs 1,366), Himalayan Distillery (+Rs 419.1), and Shivam Cement (+Rs 148). Likewise, Development Bank sub-index (+14.23%) witnessed an upswing with a rise in the share value of Lumbini Bikas (+Rs 78.6), Green Development Bank (+Rs 59) and Shine Resunga (+Rs 55).

Hydropower sub-index (+7.6%) followed suit with an escalation in the share values of Mountain Energy Nepal (+Rs 297.9), Shuvam Power (+Rs 264.8), and Samling Power (+Rs 63). Similarly, Commercial Bank sub-index (+3.96%), while still in the green zone, gained the least with an increase in share prices of NIC Asia (+Rs 70.5), Everest Bank (+Rs 35.9), and SBI Bank Nepal (+Rs 31.9).

News and Highlights

SEBON has approved broker licences to 11 additional stock brokerage firms. Nabil Securities has been licensed to work as a stock dealer, Mega Stock Markets has been granted a full working licence, and nine other companies have been given limited working licences. Nabil Securities receiving the stock dealer licence is a significant milestone in Nepal’s capital market history as it is the first time a bank has been granted approval to expand its services as a brokerage house.

On the public issues front, SEBON has approved the Initial Public Offering (IPO) of three hydropower companies and two life insurance companies. The IPOs for hydropower companies are for Upper Lohore Khola Hydropower worth Rs 509.8 million, Manakamana Engineering Hydropower worth Rs 800 million, and Bhagwati Hydropower worth Rs 572 million. NIC Asia, BOK Capital Market, and Siddhartha Capital were appointed as the respective issue managers. The IPOs of life insurance companies are IME Life Insurance worth Rs 4 billion and Reliable Nepal worth Rs 4 billion. Civil Capital Market has been appointed the issue manager for both the IPOs.

SEBON has also put the IPO of Sanima Hydropower (Rs 147 million), Kantipur Television (Rs 75 million), Him Star Urja (Rs 111.9 million), and Dish Media (Rs 13.58 million) under preliminary review. Sanima Capital has been appointed as the issue manager for the first two, while NIC Asia Capital and Prabhu Capital have been appointed for the latter two, respectively.

Outlook

The secondary market has gained momentum as investor confidence has been lifted as a result of a strong economic outlook. Further, the market growth has been supported by strong market volume. However, as the end of the fiscal year 2022/23 approaches, the market is likely to experience some selling pressure from individual and institutional investors seeking to adjust their investment portfolios and book profits from recent stock price appreciation. ![]()

This is an analysis from beed Management Pvt Ltd. No expressed or implied warrant is made for usefulness or completeness of this information and no liability will be accepted for consequences of actions taken on the basis of this analysis.